Q4 2025 | Wyoming M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

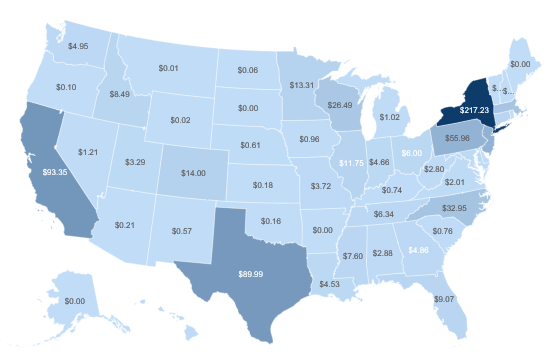

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Wyoming

Wyoming M&A Overview — Business Sale Activity for M&A Targets

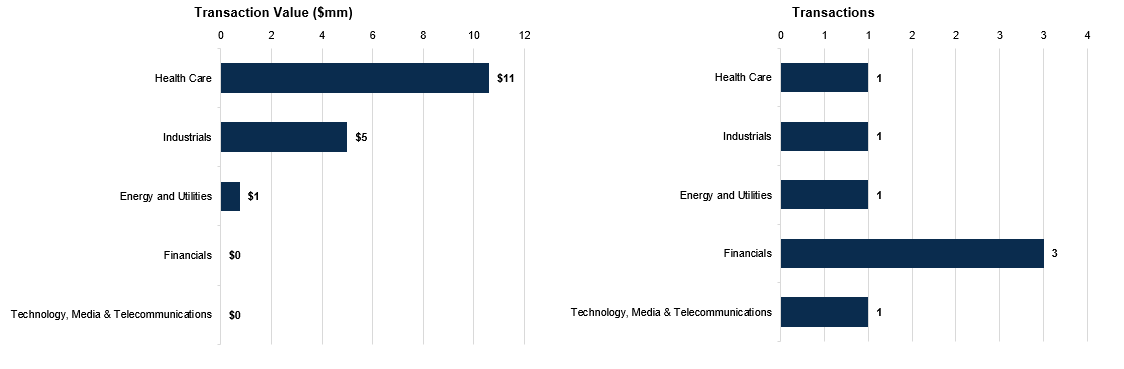

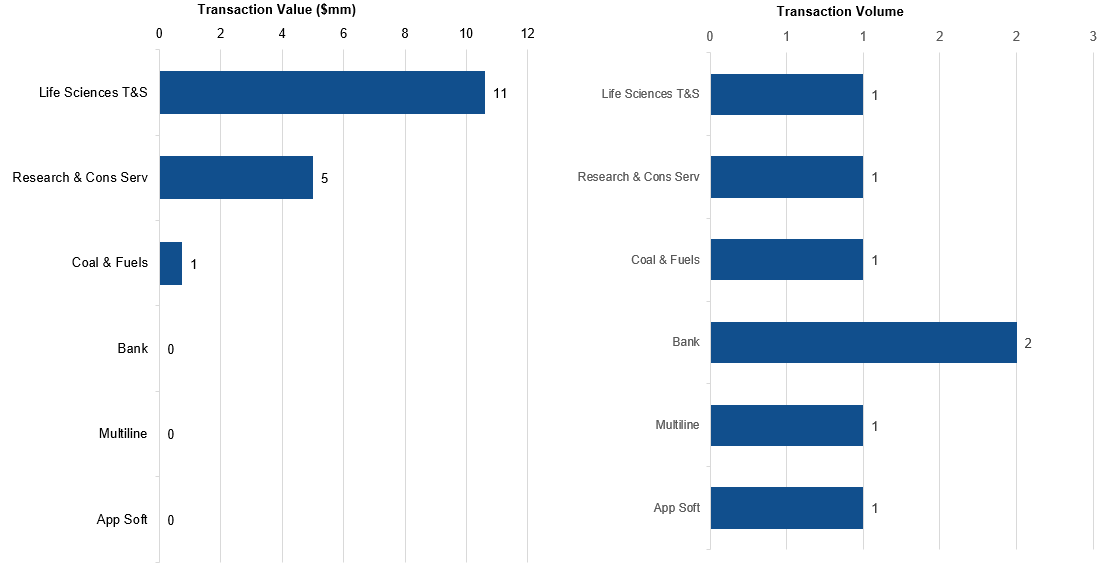

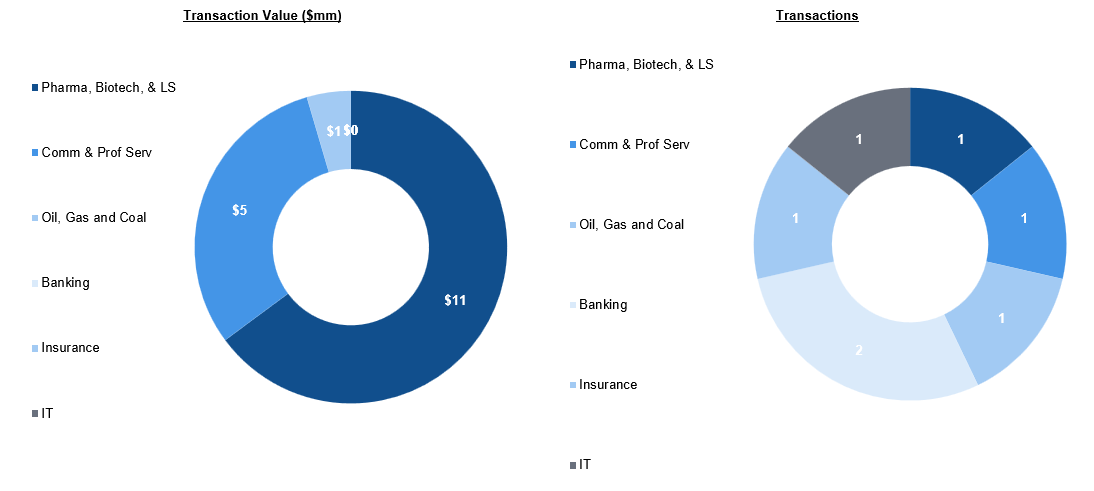

Wyoming’s M&A market in Q4 2025 reflected a compelling blend of financial services consolidation, technology-driven growth, and renewed investment in the state’s core energy and natural resources sectors. The quarter was highlighted by the acquisition of Mountain West Farm Bureau Mutual Insurance Company by IFB Mutual Insurance Holding Company, reinforcing regional agricultural insurance platforms across the Mountain West, as well as Cheyenne State Bank by Hilltop National Bank, underscoring continued consolidation among Wyoming-based community banking institutions. In parallel, the state’s growing technology footprint was evident in the acquisition of Exousia Ai, Inc. for $11 million and Rentfinder.ai LLC, signaling strategic buyer appetite for AI-enabled platforms emerging from Wyoming’s increasingly business-friendly ecosystem. Energy and mineral investment also accelerated, with transactions involving the Great Divide Basin Project and uranium-focused operators reinforcing Wyoming’s long-standing role in domestic resource development. Collectively, Q4 activity demonstrates that Wyoming remains attractive to both strategic and financial buyers seeking scalable financial services platforms, innovative technology assets, and hard-asset exposure in resilient natural resource sectors.

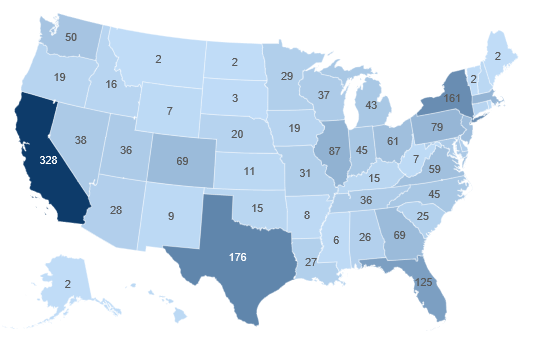

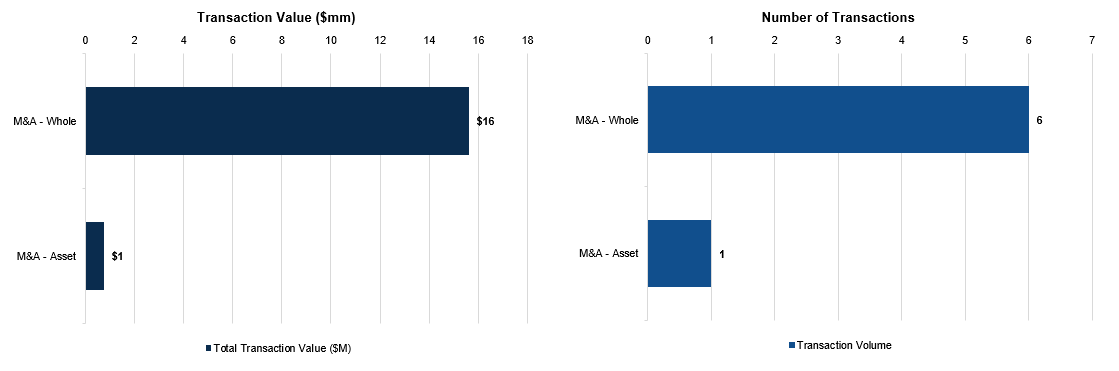

Wyoming — Strategic vs. Sponsor-led Activity

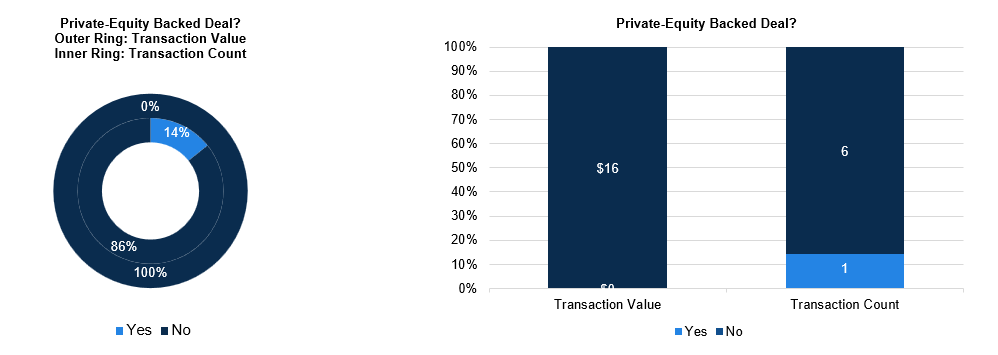

Wyoming — X / Y Plot By Sector

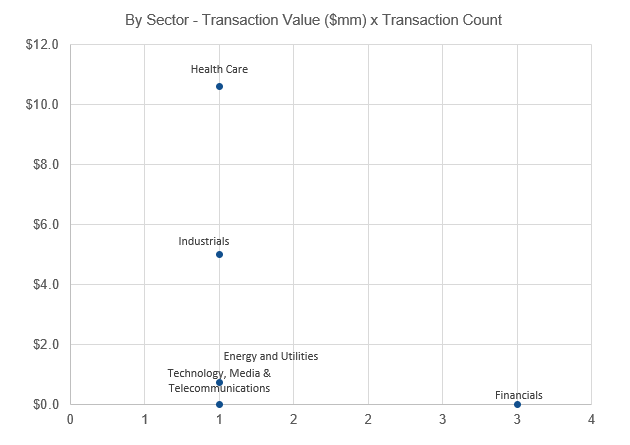

Wyoming — M&A Segmentation

Wyoming — Sector Breakdown

Second Level Primary Industry Breakdown

Wyoming M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Mountain West Farm Bureau Mutual Insurance Company (10/2/2025)

IFB Mutual Insurance Holding Company of Pocatello, ID, acquired Mountain West Farm Bureau Mutual Insurance Company of Laramie, WY, consolidating agricultural insurance operations across the Mountain West region.

2. Rentfinder.ai LLC (10/15/2025)

Rentvine LLC of Estero, FL, acquired Rentfinder.ai LLC of Sheridan, WY, strengthening its rental property technology platform with artificial intelligence-powered search capabilities.

3. UCSB Financial Corporation (10/16/2025)

Integra BG, LLC of Jackson, WY, acquired UCSB Financial Corporation of Mountain View, WY, consolidating regional financial services within the Wyoming market.

4. Cheyenne State Bank (10/27/2025)

Hilltop National Bank of Casper, WY, acquired Cheyenne State Bank of Cheyenne, WY, consolidating its position across Wyoming's key banking markets.

5. Exousia Ai, Inc. (11/17/2025)

LAMY of New York, NY, acquired Exousia Ai, Inc. of Sheridan, WY for $11M, strengthening its artificial intelligence capabilities and technology portfolio.

6. Great Divide Basin Project (12/8/2025)

Canamera Energy Metals Corp. acquired Great Divide Basin Project for $1M, advancing its uranium exploration capabilities in Wyoming's prolific energy minerals district.

7. BRS Inc. (12/18/2025)

Anfield Energy Inc. acquired BRS Inc. of Riverton, WY for $5M, consolidating uranium sector assets in Wyoming's established mining region.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence