2025 Year in Review | Wyoming M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

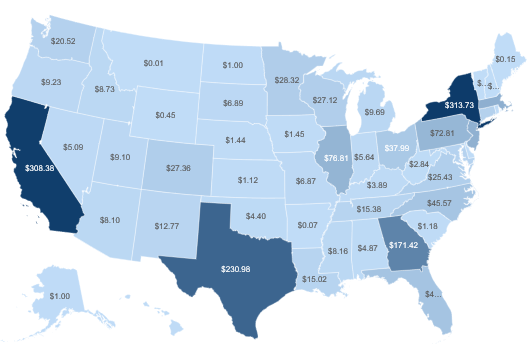

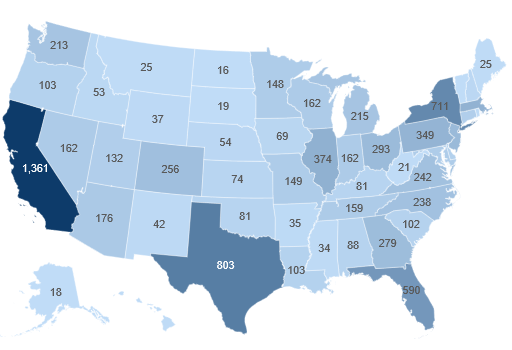

2025 - National Transaction Value ($bn) and Transaction Count

Targets in Wyoming

Wyoming M&A Overview — Business Sale Activity for M&A Targets

Wyoming’s 2025 M&A landscape reflected the state’s dual identity: a resource-rich energy hub and an increasingly diversified platform for financial services, digital infrastructure, and niche technology. The year opened with continued consolidation in wireless spectrum, as New Cingular Wireless PCS, LLC strengthened its Wyoming coverage through multiple license acquisitions—underscoring the strategic importance of rural connectivity and spectrum positioning. At the same time, energy and mining transactions defined the upper end of disclosed value. Notable deals included the $223 million acquisition of Moser Engine Service by Atlas Energy Solutions Inc., reinforcing oilfield services capabilities in the Powder River Basin, and Powder River Basin LLC’s $158 million acquisition of the Pine Ridge Project—highlighting continued capital commitment to Wyoming’s core hydrocarbon and mineral assets. Uranium exploration was especially active, with multiple project and claims acquisitions advancing positions across the Great Divide Basin and TenSleep districts as global nuclear fuel demand themes persist.

Hospitality and real asset transactions added further depth to the market. The acquisition of Snow King Resort Hotel, LLC in Jackson and the Hilton Garden Inn Casper reflected sustained investor appetite for premium Rocky Mountain tourism assets, supported by resilient leisure travel and destination-driven demand. Regional banking consolidation also accelerated, including transactions involving Cheyenne State Bank and Wyoming Bank & Trust, signaling continued scale-driven strategies among community financial institutions navigating regulatory and capital efficiency pressures.

Importantly, 2025 also demonstrated Wyoming’s quiet evolution beyond traditional sectors. Transactions involving digital media, AI, telecommunications software, environmental services, and rental property technology platforms illustrated growing appeal among strategic and private equity buyers seeking scalable, asset-light business models domiciled in the state. For business owners across Wyoming, the year’s activity reinforces a clear message: capital remains available for well-positioned companies in energy, financial services, technology, and specialty manufacturing. In a market where strategic buyers are pursuing both consolidation and capability expansion, thoughtful preparation and competitive process execution remain critical to maximizing value in today’s environment.

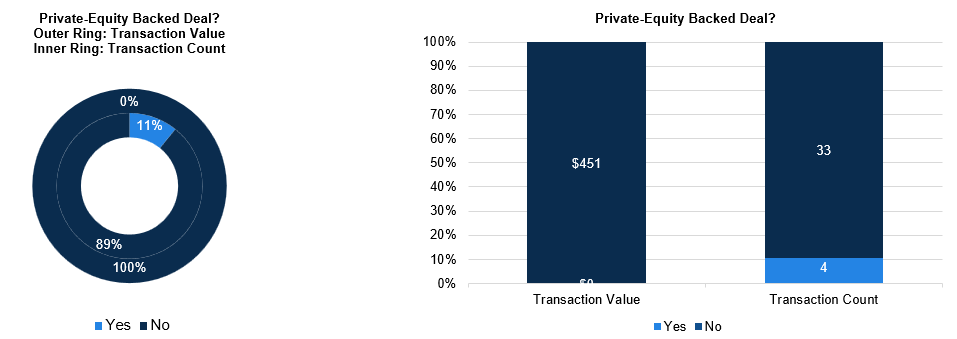

Wyoming — Strategic vs. Sponsor-led Activity

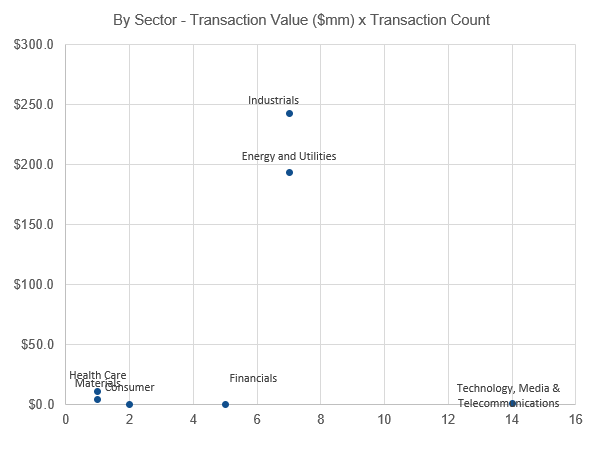

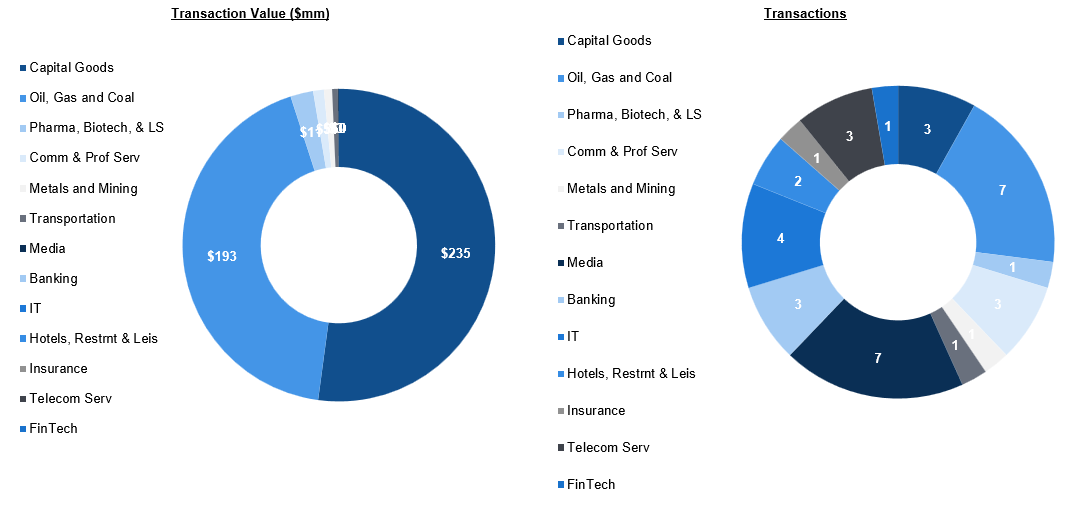

Wyoming — X / Y Plot By Sector

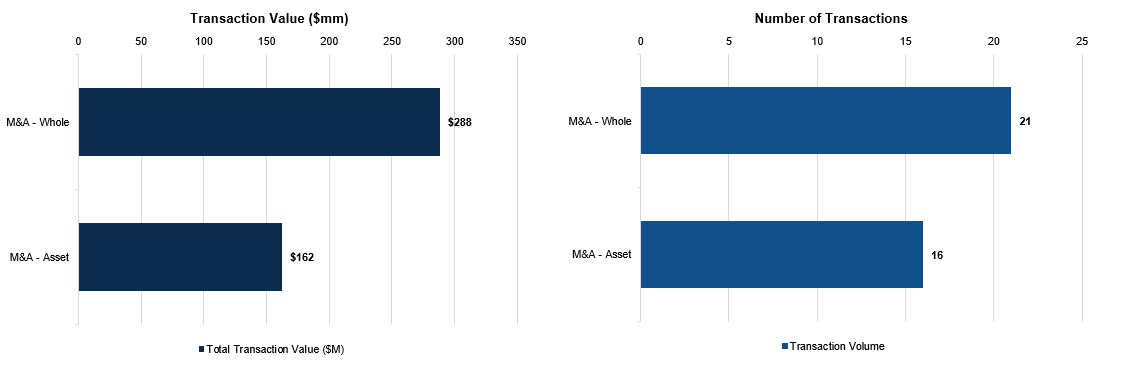

Wyoming — M&A Segmentation

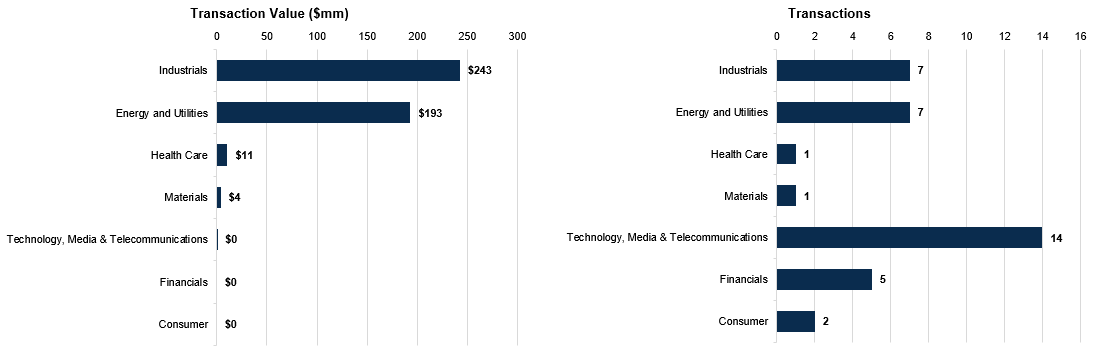

Wyoming — Sector Breakdown

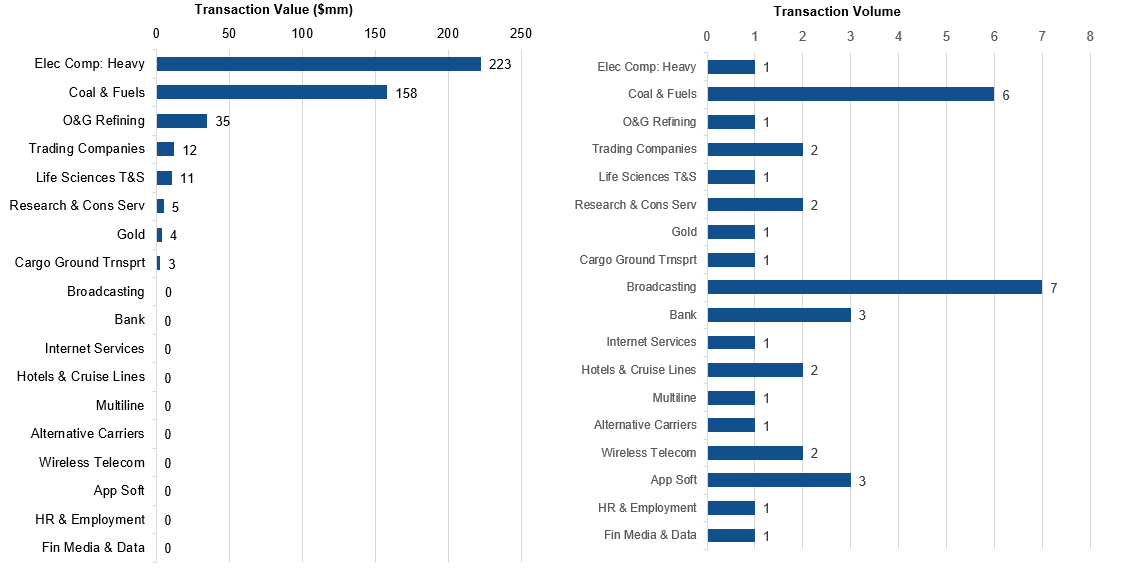

Second Level Primary Industry Breakdown

Wyoming M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Three WY Wireless Licenses (1/3/2025)

New Cingular Wireless PCS, LLC of Dallas, TX, acquired Three WY Wireless Licenses, strengthening its spectrum holdings and network coverage in Wyoming markets.

2. One WY Wireless License (1/4/2025)

New Cingular Wireless PCS, LLC of Dallas, TX, acquired One WY Wireless License, strengthening its wireless spectrum portfolio and coverage capabilities in Wyoming.

3. Mineral Hill Project (1/8/2025)

Pacific Ridge Exploration Ltd. acquired Mineral Hill Project for $4M, expanding its mineral exploration portfolio and strengthening its position in the mining sector.

4. Additional Land (1/20/2025)

Myriad Uranium Corp. acquired Additional Land, expanding its mineral exploration footprint and strengthening its position in the uranium sector.

5. Moser Engine Service, Inc. (1/27/2025)

Atlas Energy Solutions Inc. of Austin, TX, acquired Moser Engine Service, Inc. of Evansville, WY for $223M, strengthening its oilfield services capabilities in the Powder River Basin region.

6. K201HM-FX (1/29/2025)

Community Broadcasting, Inc. of Overland Park, KS, acquired K201HM-FX for $0M, expanding its radio broadcasting footprint and strengthening its market presence in the region.

7. Two FM Stations (1/29/2025)

Community Broadcasting, Inc. of Overland Park, KS, acquired Two FM Stations for $0M, strengthening its radio broadcasting portfolio and regional market presence.

8. Talentcrowd, LLC (1/31/2025)

GBQ Partners, LLC of Columbus, OH, acquired Talentcrowd, LLC of Columbus, WY, strengthening its human capital consulting and talent management capabilities.

9. K258DV-FX (2/3/2025)

Bott Communications Inc. of Overland Park, KS, acquired K258DV-FX for $0M, expanding its broadcast station portfolio and strengthening its regional media presence.

10. KRCK-FM (2/6/2025)

Cedar Cove Broadcasting, Inc. of Cheyenne, WY, acquired KRCK-FM for $0M, consolidating its regional radio portfolio and strengthening market presence in the Wyoming broadcast landscape.

11. KLLM-FM (2/18/2025)

Bott Communications, Inc. of Overland Park, KS, acquired KLLM-FM for $0M, expanding its radio broadcasting portfolio and market presence.

12. KUYO-AM (2/18/2025)

Bott Communications, Inc. of Overland Park, KS, acquired KUYO-AM for $0M, expanding its radio broadcasting footprint and strengthening its portfolio of AM radio stations.

13. Hilton Garden Inn Casper (2/19/2025)

Ad Astra Capital acquired Hilton Garden Inn Casper of Casper, WY, expanding its hospitality portfolio in the Rocky Mountain region.

14. KTDX-FM (2/24/2025)

Hi-Line Radio Fellowship, Inc. of Havre, MT, acquired KTDX-FM for $0M, expanding its Christian broadcasting reach in the regional market.

15. Mineral Claims (2/26/2025)

URZ3 Energy Corp. acquired Mineral Claims, expanding its resource base and strengthening its position in the energy minerals sector.

16. Alliance Drilling Tools LLC (3/3/2025)

Star Equity Holdings, Inc. of Old Greenwich, CT, acquired Alliance Drilling Tools LLC of Evanston, WY for $12M, strengthening its energy sector equipment capabilities and Wyoming market presence.

17. TenSleep Project (3/3/2025)

Nuclear Fuels Inc. acquired TenSleep Project, strengthening its uranium development portfolio with a strategic Wyoming-based asset.

18. Pine Ridge Project (3/12/2025)

Powder River Basin LLC acquired Pine Ridge Project for $158M, expanding its energy development portfolio in the western United States.

19. Buckshot Trucking LLC (4/1/2025)

Undisclosed Buyer acquired Buckshot Trucking LLC of Casper, WY for $3M, strengthening its transportation and logistics capabilities in the Wyoming market.

20. Additonal Claims (4/3/2025)

Global Uranium and Enrichment Limited acquired Additional Claims, expanding its uranium resource base and strengthening its position in the nuclear fuel supply chain.

21. Snow King Resort Hotel, LLC (4/17/2025)

Castle Peak Holdings LLC of New York, NY, acquired Snow King Resort Hotel, LLC of Jackson, WY, expanding its hospitality portfolio into the premium Wyoming ski resort market.

22. Z Squared Inc. (4/25/2025)

Coeptis Therapeutics Holdings, Inc. of Wexford, PA, acquired Z Squared Inc. of Cheyenne, WY, strengthening its therapeutic development capabilities and research portfolio.

23. Polygon, Inc. (5/1/2025)

Valnet Inc. acquired Polygon, Inc. of Jackson, WY, strengthening its digital media portfolio with gaming and entertainment content expertise.

24. Crunchbits LLC (5/6/2025)

Synteq Digital Operations US LLC of Wilmington, DE, acquired Crunchbits LLC of Sheridan, WY, strengthening its digital infrastructure and cloud services capabilities.

25. Slipstream Environmental Services, LLC (5/12/2025)

Alliance Technical Group, LLC of Decatur, AL, acquired Slipstream Environmental Services, LLC of Sheridan, WY, expanding its environmental services capabilities into the Wyoming market.

26. Wyoming Bank & Trust (5/16/2025)

First National Bank of Fort Pierre, SD, acquired Wyoming Bank & Trust of Cheyenne, WY, expanding its regional footprint into the Wyoming market.

27. Custom Chemical Solutions, LLC (6/18/2025)

AAVIN Private Equity Advisors of Cedar Rapids, IA, acquired Custom Chemical Solutions, LLC of Casper, WY, bolstering its portfolio of specialized chemical manufacturing and processing capabilities.

28. Rock Springs Energy Group LLC (8/5/2025)

Safe & Green Holdings Corp. of Miami, FL, acquired Rock Springs Energy Group LLC of Rock Springs, WY for $35M, expanding its energy infrastructure capabilities and establishing a strategic presence in Wyoming's energy sector.

29. NobelBiz, Inc. (9/2/2025)

bXceptional LLC of Cheyenne, WY, acquired NobelBiz, Inc. of Cheyenne, WY, strengthening its telecommunications and customer engagement technology capabilities.

30. Typhon Interactive LLC (9/15/2025)

Nexus7Media, LLC of Boca Raton, FL, acquired Typhon Interactive LLC of Cheyenne, WY, strengthening its digital media and interactive technology capabilities.

31. Mountain West Farm Bureau Mutual Insurance Company (10/2/2025)

IFB Mutual Insurance Holding Company of Pocatello, ID, acquired Mountain West Farm Bureau Mutual Insurance Company of Laramie, WY, consolidating agricultural insurance operations across the Mountain West region.

32. Rentfinder.ai LLC (10/15/2025)

Rentvine LLC of Estero, FL, acquired Rentfinder.ai LLC of Sheridan, WY, strengthening its rental property technology platform with artificial intelligence-powered search capabilities.

33. UCSB Financial Corporation (10/16/2025)

Integra BG, LLC of Jackson, WY, acquired UCSB Financial Corporation of Mountain View, WY, consolidating regional financial services within the Wyoming market.

34. Cheyenne State Bank (10/27/2025)

Hilltop National Bank of Casper, WY, acquired Cheyenne State Bank of Cheyenne, WY, consolidating its position across Wyoming's key banking markets.

35. Exousia Ai, Inc. (11/17/2025)

LAMY of New York, NY, acquired Exousia Ai, Inc. of Sheridan, WY for $11M, strengthening its artificial intelligence capabilities and technology portfolio.

36. Great Divide Basin Project (12/8/2025)

Canamera Energy Metals Corp. acquired Great Divide Basin Project for $1M, advancing its uranium exploration capabilities in Wyoming's prolific energy minerals district.

37. BRS Inc. (12/18/2025)

Anfield Energy Inc. acquired BRS Inc. of Riverton, WY for $5M, consolidating uranium sector assets in Wyoming's established mining region.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence