Q4 2025 | Oregon M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

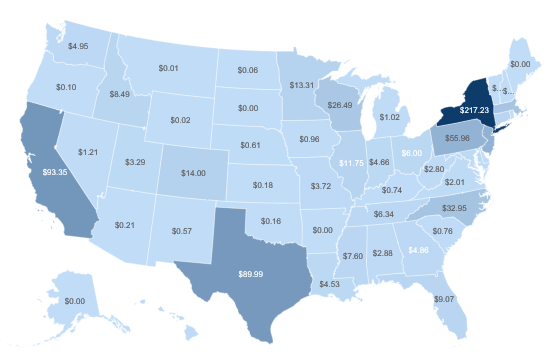

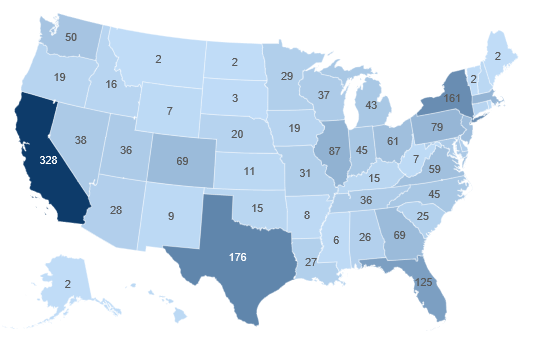

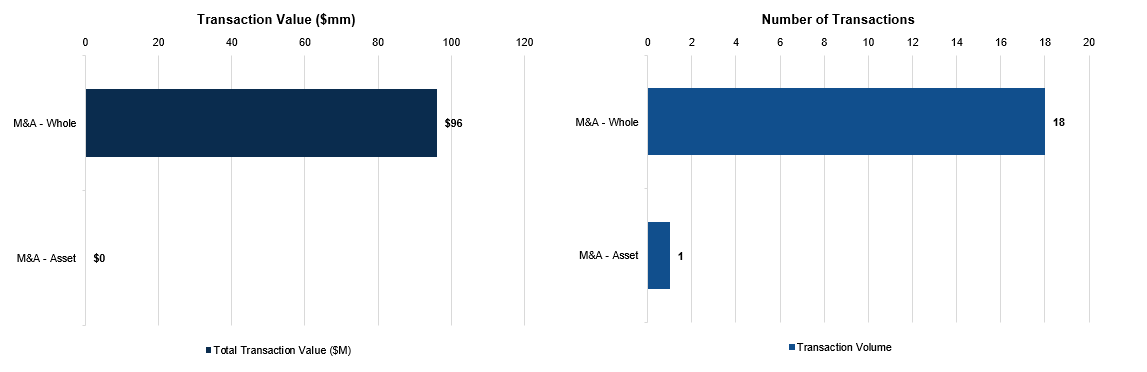

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Oregon

Oregon M&A Overview — Business Sale Activity for M&A Targets

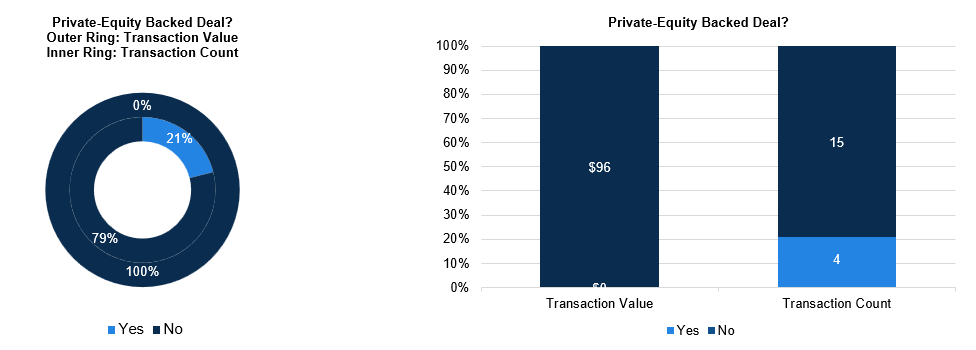

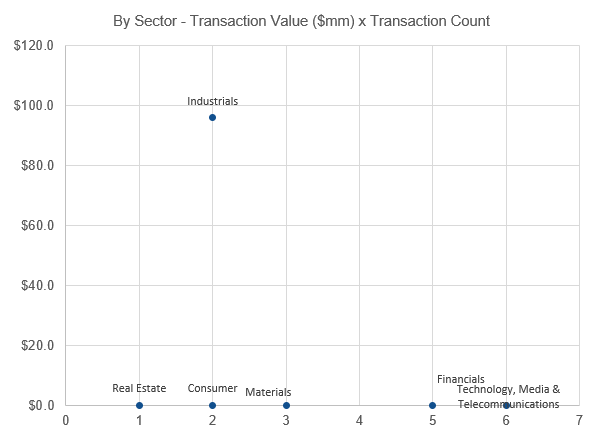

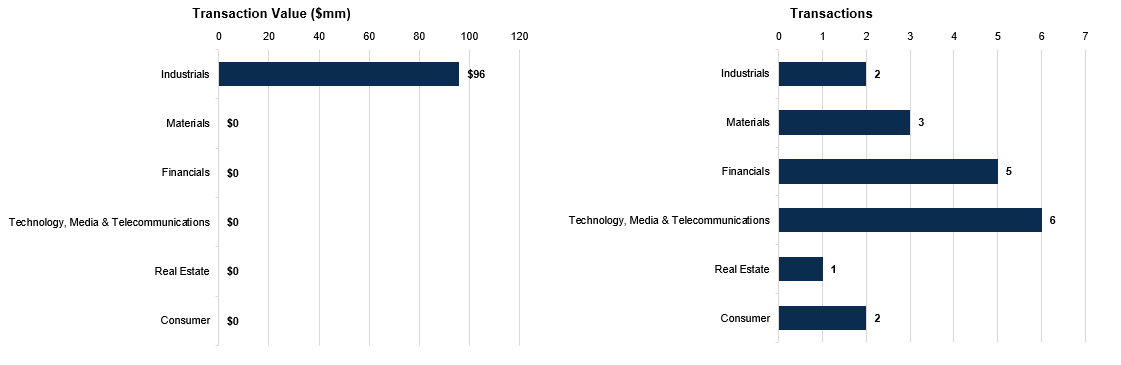

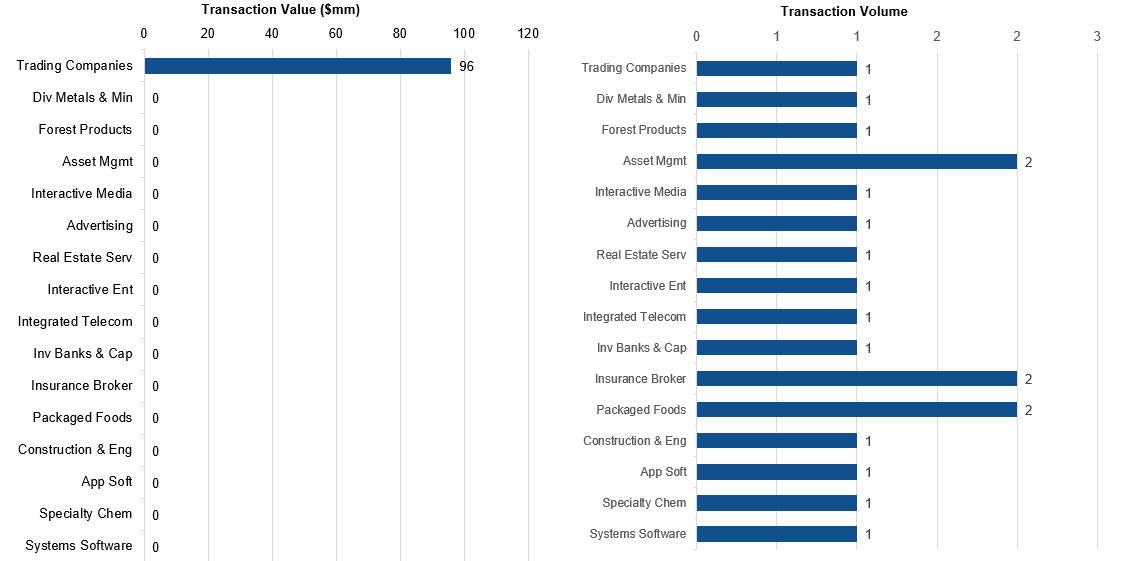

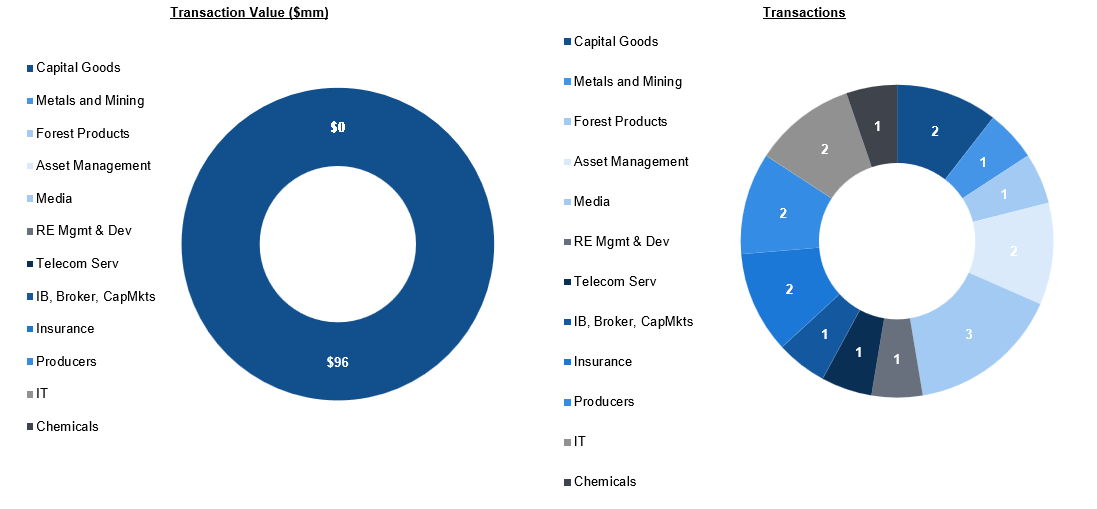

Q4 2025 M&A activity in Oregon and New Mexico reflected sustained strategic and private equity interest across industrials, technology, natural resources, and financial services, underscoring the region’s diversified economic base. In Oregon, Portland continued to anchor transaction flow, with financial services consolidation highlighted by GSR’s acquisition of Equilibrium Capital Services and Paulson Capital Holding Company’s purchase of JWTT Inc., alongside continued wealth and insurance platform expansion through EP Wealth Advisors’ acquisition of Clearview Wealth Advisors and Digital Insurance’s acquisition of Martinen LLC. Strategic buyers were equally active in industrial and building products, including BlueLinx Corporation’s $96 million acquisition of Disdero Lumber Co., Andersen Corporation’s purchase of Bright Wood Corporation, and Arclin’s acquisition of The Willamette Valley Company, reinforcing the Pacific Northwest’s importance in specialty chemicals, wood products, and distribution. Technology and cybersecurity remained focal points, with Arctic Wolf Networks acquiring UpSight Security and Noggin Holdings purchasing Got Wonder, while Oak Hill Capital-backed Hunter Communications added telecom scale in Southern Oregon. In New Mexico, mineral and resource consolidation activity, including Homeland Nickel’s acquisition of additional claims, reflected continued long-term conviction in critical minerals and exploration assets. Collectively, Q4 deal flow demonstrates that both Oregon and New Mexico remain attractive to strategic acquirers and financial sponsors seeking scalable platforms, essential service providers, and hard-asset exposure in growth-oriented Western markets.

Oregon — Strategic vs. Sponsor-led Activity

Oregon — X / Y Plot By Sector

Oregon — M&A Segmentation

Oregon — Sector Breakdown

Oregon M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Equilibrium Capital Services, LLC (10/2/2025)

GSR acquired Equilibrium Capital Services, LLC of Portland, OR, strengthening its financial services capabilities and expanding its presence in the Pacific Northwest market.

2. JWTT Inc. (10/22/2025)

Paulson Capital Holding Company, LLC of Portland, OR, acquired JWTT Inc. of Portland, OR, consolidating its position in the local market through strategic portfolio expansion.

3. Panco Foods Inc. (10/22/2025)

ESG Inc. of Kennett Square, PA, acquired Panco Foods Inc. of Portland, OR, strengthening its food manufacturing capabilities and West Coast market presence.

4. Got Wonder Inc. (10/23/2025)

Noggin Holdings, Inc. of New York, NY, acquired Got Wonder Inc. of Portland, OR, strengthening its technology capabilities and expanding its presence in the Pacific Northwest market.

5. Disdero Lumber Co., LLC (11/3/2025)

BlueLinx Corporation of Marietta, GA, acquired Disdero Lumber Co., LLC of Clackamas, OR for $96M, strengthening its Pacific Northwest building materials distribution network.

6. 350 Additional Claims (11/4/2025)

Homeland Nickel Inc. acquired 350 Additional Claims, consolidating its mineral rights portfolio and strengthening its position in the nickel exploration sector.

7. Cool Down Co (11/4/2025)

Palmetto Clean Technology, Inc. of Charlotte, NC, acquired Cool Down Co of Sacramento, OR, strengthening its cooling solutions capabilities in the Pacific Northwest market.

8. UpSight Security Inc. (11/4/2025)

Arctic Wolf Networks, Inc. of Eden Prairie, MN, acquired UpSight Security Inc. of Beaverton, OR, strengthening its cybersecurity platform with advanced threat detection and security analytics capabilities.

9. Martinen LLC (11/20/2025)

Digital Insurance, LLC of Atlanta, GA, acquired Martinen LLC of La Pine, OR, strengthening its technology capabilities and expanding its presence in the Pacific Northwest insurance market.

10. Pavement Maintenance, Inc. (11/20/2025)

Sage Surface Partners of Dallas, TX, acquired Pavement Maintenance, Inc. of Portland, OR, expanding its geographic footprint in the Pacific Northwest pavement services market.

11. TES-Software, Inc. (11/25/2025)

Kev Group Inc. acquired TES-Software, Inc. of Cottage Grove, OR, strengthening its technology capabilities and software development portfolio.

12. Undisclosed Insurance Agency (12/1/2025)

Undisclosed Buyer acquired Undisclosed Insurance Agency, consolidating its presence in the insurance brokerage sector.

13. Galash Lawrence Inc (12/4/2025)

J.S. Held, LLC of Jericho, NY, acquired Galash Lawrence Inc of Bend, OR, reinforcing its forensic accounting and investigative services capabilities in the Pacific Northwest market.

14. Bright Wood Corporation (12/10/2025)

Andersen Corporation of Bayport, MN, acquired Bright Wood Corporation of Madras, OR, strengthening its wood products manufacturing capabilities and Pacific Northwest market presence.

15. Hunter Communications, Inc. (12/10/2025)

Oak Hill Capital Management, LLC of New York, NY, acquired Hunter Communications, Inc. of Central Point, OR, strengthening its portfolio of telecommunications and technology service providers.

16. Mushroom Madness, Inc. (12/10/2025)

FBC Holding, Inc. of Chandler, AZ, acquired Mushroom Madness, Inc. of Portland, OR, consolidating its position in the specialty food and fungi cultivation market.

17. Clearview Wealth Advisors, LLC (12/16/2025)

EP Wealth Advisors, LLC of Torrance, CA, acquired Clearview Wealth Advisors, LLC of Salem, OR, expanding its wealth management presence in the Pacific Northwest market.

18. Downstream LLC (12/18/2025)

Elevate Sports Ventures Inc. of New York, NY, acquired Downstream LLC of Portland, OR, strengthening its sports media and content capabilities in the Pacific Northwest market.

19. The Willamette Valley Company, LLC (12/18/2025)

Arclin, Inc. of Alpharetta, GA, acquired The Willamette Valley Company, LLC of Eugene, OR, strengthening its specialty chemicals and adhesives portfolio in the Pacific Northwest market.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence