2025 Year in Review | Oregon M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

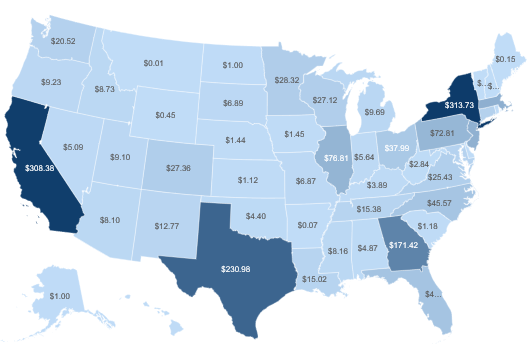

2025 - National Transaction Value ($bn) and Transaction Count

Targets in Oregon

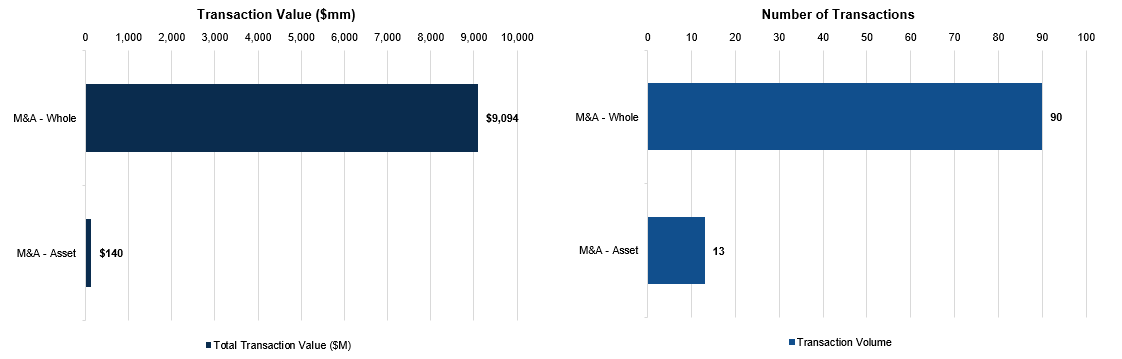

Oregon M&A Overview — Business Sale Activity for M&A Targets

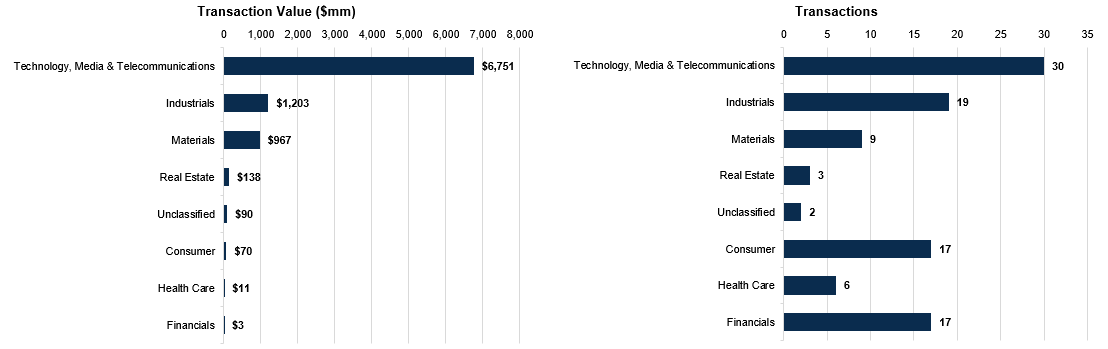

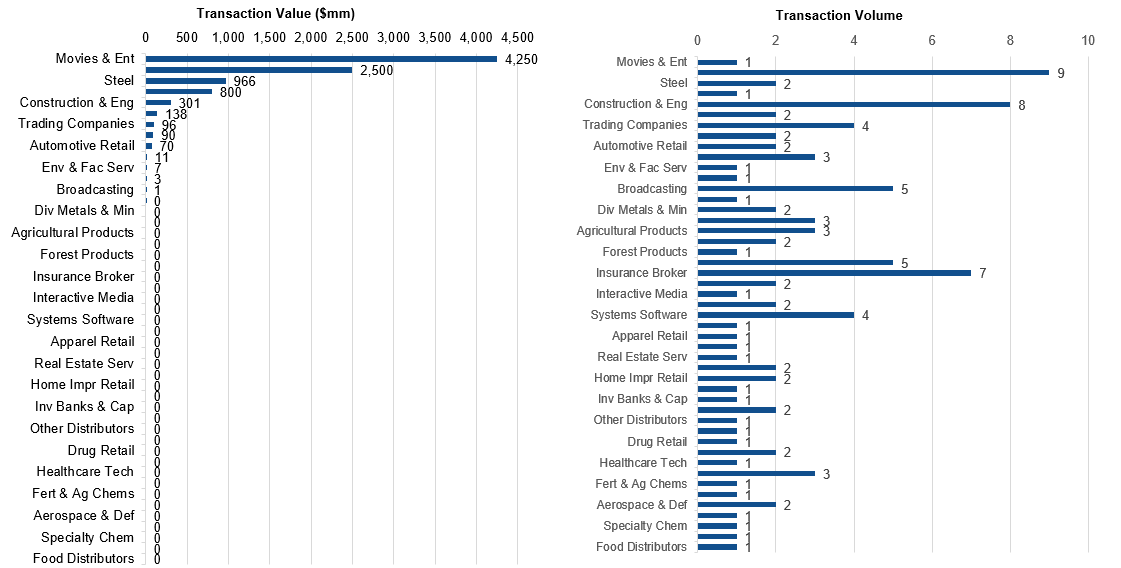

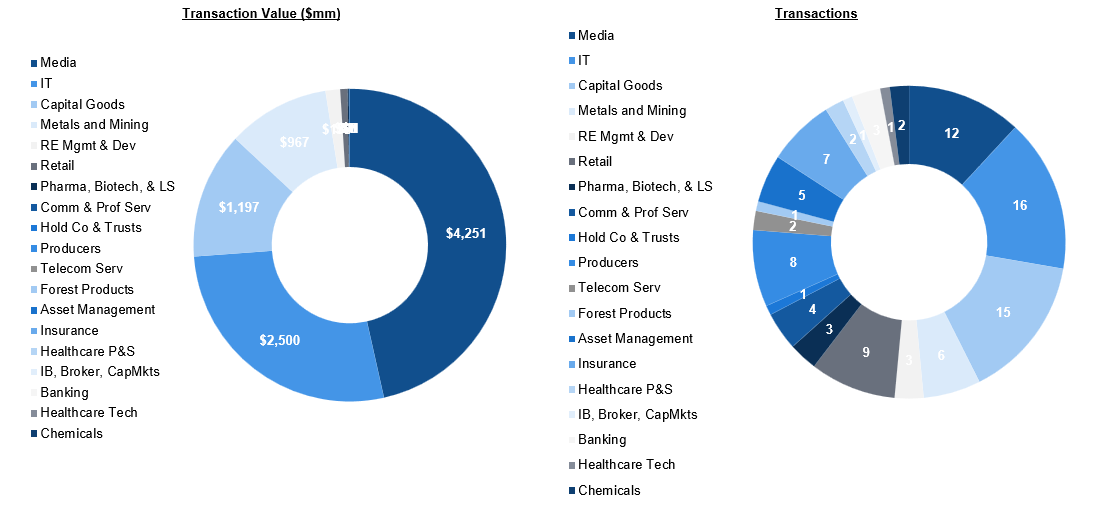

Oregon’s 2025 M&A landscape reflected a dynamic and diversified market, with over 100 announced transactions spanning technology, advanced manufacturing, natural resources, healthcare, financial services, and consumer sectors. The year was defined not only by volume, but by the scale of marquee transactions that placed Oregon squarely on the national M&A map. Standout deals included the $4.25 billion acquisition of the Portland Trail Blazers, the $2.5 billion acquisition of NAVEX Global, and Toyota Tsusho America’s $913 million purchase of Radius Recycling—each underscoring institutional appetite for scalable platforms headquartered in the Pacific Northwest. In parallel, significant industrial and infrastructure transactions such as I Squared Capital’s $800 million acquisition of ENTEK International and Andersen Corporation’s acquisition of Bright Wood Corporation highlighted sustained strategic interest in Oregon’s manufacturing and engineered wood capabilities.

Technology and innovation-driven businesses remained central to buyer activity. Transactions involving DeepSurface Security (cybersecurity), FlowiseAI (AI workflow automation), CollegeNET (higher education software), Origami Solar (renewable energy technology), and UpSight Security reinforced Oregon’s strength in enterprise software, AI, clean energy, and advanced analytics. Financial services and insurance brokerage consolidation also remained active, with recurring acquisitions by BroadStreet Partners and EP Wealth Advisors, among others, signaling continued roll-up strategies across advisory and insurance platforms. Meanwhile, healthcare services, specialty pharmacy, engineering consultancies, and managed IT providers attracted both private equity and strategic acquirers seeking regional expansion and recurring revenue profiles.

Industrials, construction materials, agriculture, and natural resources transactions provided further evidence of Oregon’s structural economic depth. Deals involving metal processing, building products distribution, grain handling, vineyard management, lumber, aggregate and paving, and mineral claims demonstrate that traditional sectors continue to command strong strategic interest when paired with operational scale or geographic advantage. Commercial real estate and telecommunications infrastructure transactions—such as the $93 million acquisition of Tanasbourne Village and Oak Hill Capital’s acquisition of Hunter Communications—reflected continued investment in long-duration assets and essential services. Overall, 2025 illustrated a balanced and resilient Oregon M&A environment, where both middle-market founder-led businesses and scaled institutional platforms successfully attracted national capital across a broad spectrum of industries.

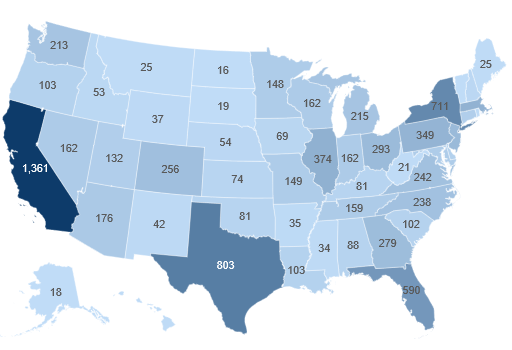

Oregon — Strategic vs. Sponsor-led Activity

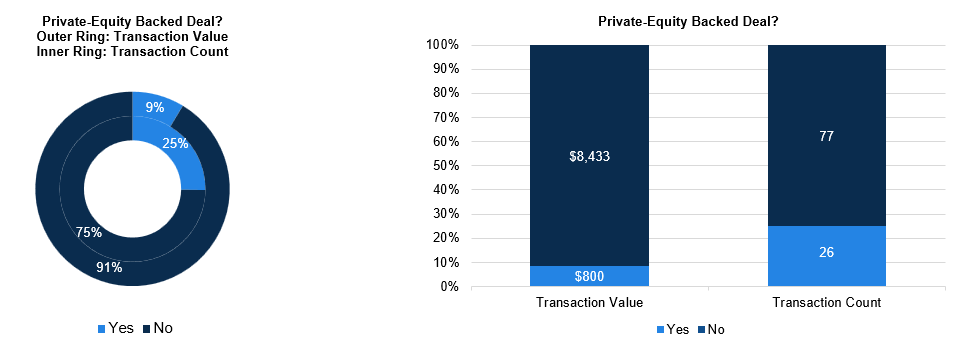

Oregon — X / Y Plot By Sector

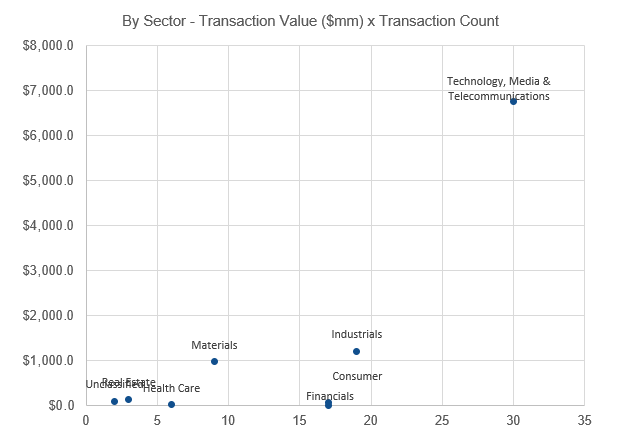

Oregon — M&A Segmentation

Oregon — Sector Breakdown

Oregon M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Certain insurance Assets (1/1/2025)

BroadStreet Partners, Inc. of Columbus, OH, acquired Certain insurance Assets, strengthening its insurance portfolio and expanding its capabilities in the sector.

2. Sasco Fasteners (1/3/2025)

Five Point Acquisitions, LLC of Salem, OR, acquired Sasco Fasteners of Medford, OR, consolidating its position in the Pacific Northwest industrial supply market.

3. The Whole Bowl, Inc. (1/6/2025)

Moberi LLC of Portland, OR, acquired The Whole Bowl, Inc. of Portland, OR, consolidating its position in the local healthy fast-casual dining market.

4. ORCAL, Inc. (1/7/2025)

BADEN CAPITAL acquired ORCAL, Inc. of Junction City, OR, strengthening its portfolio of technology solutions and expanding its presence in the Pacific Northwest market.

5. TNT Sales of Oregon, LLC (1/9/2025)

Utility Trailer Sales Of Central California, Inc. of Lathrop, CA, acquired TNT Sales of Oregon, LLC of Troutdale, OR, expanding its trailer sales operations into the Pacific Northwest market.

6. Civil West Engineering Services, Inc. (1/14/2025)

Verdantas LLC of Tampa, FL, acquired Civil West Engineering Services, Inc. of Coos Bay, OR, strengthening its Pacific Northwest presence and civil engineering capabilities in the Oregon market.

7. Metabolic Maintenance Products, Inc. (1/14/2025)

Allergy Research Group LLC of Alameda, CA, acquired Metabolic Maintenance Products, Inc. of Sisters, OR, strengthening its nutritional supplement portfolio and expanding its reach in the specialized metabolic health market.

8. Weddle Surveying, Inc. (1/14/2025)

ZenaTech, Inc. acquired Weddle Surveying, Inc. of Tigard, OR for $1M, strengthening its geospatial and mapping capabilities in the Pacific Northwest surveying market.

9. Delta AV (1/21/2025)

Conference Technologies Inc. of Maryland Heights, MO, acquired Delta AV of Gresham, OR, strengthening its audiovisual technology and conference services capabilities in the Pacific Northwest market.

10. Pipeworks, Inc. (1/22/2025)

Virtuos Ltd. acquired Pipeworks, Inc. of Eugene, OR, strengthening its global video game development capabilities and expanding its North American studio network.

11. OmniData Insights, Inc. (1/23/2025)

Fresche Solutions Inc. acquired OmniData Insights, Inc. of Portland, OR, strengthening its data analytics and business intelligence capabilities.

12. Elcon Associates, Inc. (2/3/2025)

David Evans and Associates, Inc. of Portland, OR, acquired Elcon Associates, Inc. of Beaverton, OR, consolidating engineering and consulting capabilities within the Pacific Northwest market.

13. MCAM Northwest, Inc (2/3/2025)

CNC Software, LLC of Tolland, CT, acquired MCAM Northwest, Inc of Oregon City, OR, strengthening its computer-aided manufacturing software solutions and expanding its West Coast market presence.

14. DeepSurface Security, Inc. (2/4/2025)

AttackIQ, Inc. of Los Altos, CA, acquired DeepSurface Security, Inc. of Portland, OR, strengthening its cybersecurity testing platform with advanced attack surface management capabilities.

15. JLA Supply, Inc (2/4/2025)

White Cap Supply Holdings, LLC of Doraville, GA, acquired JLA Supply, Inc of Portland, OR, strengthening its construction supply distribution footprint in the Pacific Northwest market.

16. Northwest Polymers, LLC (2/10/2025)

The AZEK Company Inc. of Chicago, IL, acquired Northwest Polymers, LLC of Molalla, OR for $7M, strengthening its polymer manufacturing capabilities and West Coast production footprint.

17. Pump Dynamics (2/12/2025)

Impel Company of Bellevue, WA, acquired Pump Dynamics of Hillsboro, OR, strengthening its fluid handling technology capabilities and regional market presence.

18. Velox Systems (2/12/2025)

CMIT Solutions, LLC of Austin, TX, acquired Velox Systems of Bend, OR, strengthening its managed IT services capabilities and expanding its geographic footprint in the Pacific Northwest.

19. David Evans and Associates, Inc. (2/18/2025)

AtkinsR�alis Group Inc. acquired David Evans and Associates, Inc. of Portland, OR for $300M, strengthening its engineering and consulting capabilities in the Pacific Northwest market.

20. Gateway Medical Pharmacy Inc. (2/18/2025)

Medicure Pharma Inc. of Princeton, NJ, acquired Gateway Medical Pharmacy Inc. of Portland, OR, expanding its pharmaceutical distribution capabilities on the West Coast.

21. LeadVenture, Inc. (2/20/2025)

Majco, Inc. of Moorpark, CA, acquired LeadVenture, Inc. of Lake Oswego, OR, strengthening its lead generation and customer acquisition capabilities.

22. Secure Pacific/Sonitrol Pacific (2/20/2025)

Pye-Barker Fire & Safety, LLC of Alpharetta, GA, acquired Secure Pacific/Sonitrol Pacific, expanding its security and fire protection services footprint on the West Coast.

23. KQUA-LP (2/26/2025)

Strategic Initiatives of Roseburg, OR, acquired KQUA-LP, expanding its local media presence and broadcasting capabilities in the Pacific Northwest market.

24. CollegeNET, Inc. (3/4/2025)

Rubicon Technology Partners of Boulder, CO, acquired CollegeNET, Inc. of Portland, OR, strengthening its portfolio of higher education technology solutions and student information systems.

25. Microvellum, Inc. (3/7/2025)

Innergy, Inc. of Austin, TX, acquired Microvellum, Inc. of Central Point, OR, strengthening its software solutions portfolio for the woodworking and cabinet manufacturing industry.

26. Willamette Valley Meat Company (3/7/2025)

Bochi Investments, LLC of Lake Oswego, OR, acquired Willamette Valley Meat Company of Portland, OR, consolidating its position in the Pacific Northwest meat processing and distribution market.

27. Citifyd, Inc. (3/11/2025)

Events.com, Inc. of La Jolla, CA, acquired Citifyd, Inc. of Portland, OR, strengthening its event technology platform with enhanced verification and authentication capabilities.

28. EC Electric (3/11/2025)

E-J Electric Installation Co, Inc. of Long Island City, NY, acquired EC Electric of Portland, OR, expanding its electrical contracting capabilities across the West Coast market.

29. Radius Recycling, Inc. (3/13/2025)

Toyota Tsusho America, Inc. of New York, NY, acquired Radius Recycling, Inc. of Portland, OR for $913M, strengthening its metal recycling and scrap processing capabilities in the North American market.

30. Three FM Stations (3/14/2025)

Alexandra Communications, Inc. of Walla Walla, WA, acquired Three FM Stations for $0M, consolidating its regional radio broadcasting presence in the Pacific Northwest market.

31. KaiPerm Northwest Federal Credit Union (3/17/2025)

Consolidated Federal Credit Union of Portland, OR, acquired KaiPerm Northwest Federal Credit Union of Portland, OR, consolidating market presence and expanding member services within the Pacific Northwest region.

32. FirePro LLC (3/20/2025)

Performance Systems Integration, LLC of Portland, OR, acquired FirePro LLC of Bend, OR, strengthening its fire protection and safety systems capabilities in the Pacific Northwest market.

33. Efuego Corp. (3/31/2025)

Inversal Inc. of Dover, DE, acquired Efuego Corp. of Eugene, OR, strengthening its technology capabilities and expanding its West Coast market presence.

34. Metal Technology, Inc. (4/2/2025)

Karman Holdings Inc. of Huntington Beach, CA, acquired Metal Technology, Inc. of Albany, OR for $90M, strengthening its manufacturing capabilities and expanding its presence in the Pacific Northwest metals processing market.

35. Hennick's Home Center, Inc. (4/3/2025)

Gold Beach Lumber Yard, Inc. of Gold Beach, OR, acquired Hennick's Home Center, Inc. of Bandon, OR, consolidating its market presence along the southern Oregon coast.

36. Bornite Project (4/4/2025)

Ameriwest Lithium Inc. acquired Bornite Project for $0M, strengthening its lithium exploration portfolio and expanding its presence in critical battery metal resources.

37. Lewis & Clark Bancorp (4/14/2025)

Marion and Polk Schools Credit Union of Salem, OR, acquired Lewis & Clark Bancorp of Oregon City, OR, consolidating its presence in the Oregon banking market.

38. Rosen Aviation, LLC (4/21/2025)

Mid Continent Controls, Inc. of Derby, KS, acquired Rosen Aviation, LLC of Eugene, OR, strengthening its position in the aviation electronics and display systems market.

39. Del Oeste Equine Hospital LLC (4/22/2025)

Altano North America Equine Veterinary Partners, LLC of Lexington, KY, acquired Del Oeste Equine Hospital LLC of Junction City, OR, expanding its specialized equine veterinary services network into the Pacific Northwest market.

40. Novillus LLC (4/22/2025)

Reveleer, Inc. of Glendale, CA, acquired Novillus LLC of Portland, OR, strengthening its healthcare data analytics and risk adjustment capabilities.

41. KNCU-FM (4/28/2025)

KORE Broadcasting LLC of Eugene, OR, acquired KNCU-FM for $0M, expanding its radio station portfolio and strengthening its presence in the local broadcasting market.

42. Adopt (4/29/2025)

Publicis Groupe S.A. acquired Adopt of Portland, OR, strengthening its digital marketing capabilities and customer experience solutions portfolio.

43. Baker & Murakami Produce Company LLLP (4/29/2025)

Eagle Eye Produce, Inc. of Idaho Falls, ID, acquired Baker & Murakami Produce Company LLLP of Ontario, OR, consolidating its regional produce distribution network across the Pacific Northwest.

44. Tomlin Insurance, Inc. (4/30/2025)

Heffernan Insurance Brokers, Inc. of Walnut Creek, CA, acquired Tomlin Insurance, Inc. of Springfield, OR, expanding its Pacific Northwest presence and strengthening its regional brokerage network.

45. Host Industries, Inc. (5/1/2025)

Private Investor acquired Host Industries, Inc. of Bend, OR, strengthening its portfolio of industrial manufacturing and distribution capabilities in the Pacific Northwest market.

46. The Radiant Sparkling Wine Company, LLC (5/1/2025)

Vinovate Custom Wine Services of Newberg, OR, acquired The Radiant Sparkling Wine Company, LLC of McMinnville, OR, expanding its portfolio to include premium sparkling wine production capabilities.

47. Alpha Media USA LLC (5/5/2025)

Connoisseur Media, LLC of Milford, CT, acquired Alpha Media USA LLC of Portland, OR, consolidating its position in the radio broadcasting market and expanding its geographic reach across key regional markets.

48. Parker Management LLC (5/12/2025)

Propagate Content LLC of Los Angeles, CA, acquired Parker Management LLC of Portland, OR, expanding its talent representation and content production capabilities in the Pacific Northwest market.

49. Mid Columbia Producers, Inc. (5/13/2025)

Northwest Grain Growers, Inc. of Walla Walla, WA, acquired Mid Columbia Producers, Inc. of Moro, OR, consolidating grain handling and agricultural services across the Pacific Northwest region.

50. Results Partners LLP (5/30/2025)

Atlas Vineyard Management, Inc. of Napa, CA, acquired Results Partners LLP of McMinnville, OR, strengthening its vineyard consulting capabilities in Oregon's premier wine-growing region.

51. Cable Hill Partners, LLC (6/1/2025)

Coldstream Capital Management, Inc. of Bellevue, WA, acquired Cable Hill Partners, LLC of Portland, OR, strengthening its investment management capabilities and expanding its Pacific Northwest client base.

52. Eldorado East Poject (6/4/2025)

Provenance Gold Corp. acquired Eldorado East Project, expanding its precious metals exploration portfolio and strengthening its position in the gold mining sector.

53. BendTel Inc. (6/5/2025)

Vero Broadband, LLC of Boulder, CO, acquired BendTel Inc. of Bend, OR, strengthening its telecommunications infrastructure and expanding its fiber broadband services into the Central Oregon market.

54. Pediatric Dental Associates of Salem, PC (6/9/2025)

Salt Dental Collective, LLC of Phoenix, AZ, acquired Pediatric Dental Associates of Salem, PC of Salem, OR, expanding its specialized pediatric dentistry services into the Pacific Northwest market.

55. Johnson Benefit Planning (6/10/2025)

Alliant Insurance Services, Inc. of Irvine, CA, acquired Johnson Benefit Planning of Bend, OR, strengthening its employee benefits consulting capabilities in the Pacific Northwest market.

56. D&H Flagging, Inc. (6/12/2025)

The Universal Group acquired D&H Flagging, Inc. of Portland, OR, strengthening its traffic control and construction safety services capabilities in the Pacific Northwest market.

57. Unosquare, LLC (6/12/2025)

Ridgemont Partners Management, LLC of Charlotte, NC, acquired Unosquare, LLC of Portland, OR, strengthening its technology services portfolio with enhanced software development and digital transformation capabilities.

58. Kinco International, Inc. (6/23/2025)

Mechanix Wear LLC of Valencia, CA, acquired Kinco International, Inc. of Portland, OR, strengthening its position in the work glove and hand protection market.

59. The Headquarters Group, Inc. (6/24/2025)

THC Therapeutics, Inc. of Jacksboro, TX, acquired The Headquarters Group, Inc. of Medford, OR for $11M, consolidating its operational infrastructure and management capabilities.

60. Certain Insurance Assets (7/1/2025)

BroadStreet Partners, Inc. of Columbus, OH, acquired Certain Insurance Assets, strengthening its insurance portfolio and expanding its capabilities in the financial services sector.

61. ST Holdings Group, LLC. (7/9/2025)

THC Therapeutics, Inc. of Jacksboro, TX, acquired ST Holdings Group, LLC. of Eugene, OR for $3M, consolidating its position in the cannabis therapeutics market.

62. U.S. Bancorp Tower (7/9/2025)

Undisclosed Buyer acquired U.S. Bancorp Tower for $45M, consolidating its commercial real estate portfolio in a prime urban market.

63. Rick's Custom Fencing And Decking, Inc. (7/18/2025)

Tenex Capital Management, L.P. of New York, NY, acquired Rick's Custom Fencing And Decking, Inc. of Hillsboro, OR, expanding its portfolio in the residential and commercial outdoor construction services sector.

64. NAVEX Global, Inc. (7/21/2025)

Investor Group acquired NAVEX Global, Inc. of Lake Oswego, OR for $2,500M, consolidating its position in the enterprise risk management and compliance software market.

65. Portland Local No. 8 Federal Credit Union (7/30/2025)

I.L.W.U. Federal Credit Union of Long Beach, CA, acquired Portland Local No. 8 Federal Credit Union of Portland, OR, consolidating maritime union financial services along the West Coast.

66. High Desert Aggregate & Paving, Inc. (7/31/2025)

Knife River Corporation of Bismarck, ND, acquired High Desert Aggregate & Paving, Inc. of Terrebonne, OR, strengthening its construction materials and paving operations in the Pacific Northwest market.

67. Certain Insurance Assets (8/1/2025)

BroadStreet Partners, Inc. of Columbus, OH, acquired Certain Insurance Assets, strengthening its insurance portfolio and expanding its presence in the insurance sector.

68. Managed Healthcare Pharmacy (8/4/2025)

Guardian Pharmacy Services, Inc. of Atlanta, GA, acquired Managed Healthcare Pharmacy of Eugene, OR, strengthening its specialized pharmaceutical services footprint in the Pacific Northwest market.

69. Precise Flight, Inc. (8/11/2025)

Signia Aerospace, LLC of Vancouver, WA, acquired Precise Flight, Inc. of Bend, OR, strengthening its aviation technology capabilities and expanding its aerospace product portfolio.

70. Performance Systems Integration, LLC (8/12/2025)

Summit Fire & Security LLC of Reno, NV, acquired Performance Systems Integration, LLC of Portland, OR, strengthening its fire and security systems capabilities in the Pacific Northwest market.

71. Trail Blazers, Inc. (8/13/2025)

Private Investor acquired Trail Blazers, Inc. of Portland, OR for $4,250M, positioning for significant expansion in the professional sports and entertainment market.

72. FlowiseAI Inc. (8/14/2025)

Workday, Inc. of Pleasanton, CA, acquired FlowiseAI Inc. of Beaverton, OR, reinforcing its human capital management platform with advanced AI-powered workflow automation capabilities.

73. Several Mining Claims (8/18/2025)

Homeland Nickel Inc. acquired Several Mining Claims, expanding its mineral resource portfolio and strengthening its position in the nickel extraction sector.

74. Eagle Wealth Management Incorporated/ Eagle Wealth Accounting, LLC (9/2/2025)

Mercer Global Advisors Inc. of Denver, CO, acquired Eagle Wealth Management Incorporated/ Eagle Wealth Accounting, LLC, consolidating its comprehensive wealth management and accounting services platform.

75. Ignition GTM, Inc. (9/2/2025)

Klue Labs Inc. acquired Ignition GTM, Inc. of Beaverton, OR, strengthening its competitive intelligence platform with enhanced go-to-market capabilities.

76. Chalice Vineyards, LLC (9/4/2025)

WarRoom Ventures, LLC of Santa Margarita, CA, acquired Chalice Vineyards, LLC of Springfield, OR, expanding its wine portfolio and strengthening its presence in the Pacific Northwest wine market.

77. KOXO-CD (9/4/2025)

TV-49, Inc. of Chicago, IL, acquired KOXO-CD for $1M, strengthening its local broadcast television portfolio and market presence.

78. Velotech, Inc. (9/4/2025)

Backcountry.com, LLC of Park City, UT, acquired Velotech, Inc. of Portland, OR, strengthening its cycling technology capabilities and expanding its specialized gear offerings for outdoor enthusiasts.

79. Origami Solar, Inc. (9/8/2025)

Nextracker Inc. of Fremont, CA, acquired Origami Solar, Inc. of Bend, OR for $53M, strengthening its solar tracking technology portfolio and expanding its renewable energy solutions capabilities.

80. KitBash3D LLC (9/10/2025)

Greyscalegorilla, Inc. of Chicago, IL, acquired KitBash3D LLC of Portland, OR, strengthening its digital content creation platform with expanded 3D asset libraries and modeling resources.

81. ENTEK International LLC (9/17/2025)

I Squared Capital Advisors, LLC of Miami, FL, acquired ENTEK International LLC of Lebanon, OR for $800M, strengthening its portfolio of advanced manufacturing and industrial technology companies.

82. Orepac Holding Co., Inc. (9/19/2025)

Specialty Building Products, Inc. of Duluth, GA, acquired Orepac Holding Co., Inc. of Wilsonville, OR, consolidating its presence in the Pacific Northwest construction materials market.

83. LBMP, LLC (9/23/2025)

Swickard Auto Group acquired LBMP, LLC of Portland, OR for $70M, strengthening its Pacific Northwest dealership footprint and expanding regional market presence.

84. Tanasbourne Village (9/30/2025)

Kimco Realty Corporation of Jericho, NY, acquired Tanasbourne Village for $93M, strengthening its retail property portfolio in the Pacific Northwest market.

85. Equilibrium Capital Services, LLC (10/2/2025)

GSR acquired Equilibrium Capital Services, LLC of Portland, OR, strengthening its financial services capabilities and expanding its presence in the Pacific Northwest market.

86. JWTT Inc. (10/22/2025)

Paulson Capital Holding Company, LLC of Portland, OR, acquired JWTT Inc. of Portland, OR, consolidating its position in the local market through strategic portfolio expansion.

87. Panco Foods Inc. (10/22/2025)

ESG Inc. of Kennett Square, PA, acquired Panco Foods Inc. of Portland, OR, strengthening its food manufacturing capabilities and West Coast market presence.

88. Got Wonder Inc. (10/23/2025)

Noggin Holdings, Inc. of New York, NY, acquired Got Wonder Inc. of Portland, OR, strengthening its technology capabilities and expanding its presence in the Pacific Northwest market.

89. Disdero Lumber Co., LLC (11/3/2025)

BlueLinx Corporation of Marietta, GA, acquired Disdero Lumber Co., LLC of Clackamas, OR for $96M, strengthening its Pacific Northwest building materials distribution network.

90. 350 Additional Claims (11/4/2025)

Homeland Nickel Inc. acquired 350 Additional Claims, consolidating its mineral rights portfolio and strengthening its position in the nickel exploration sector.

91. Cool Down Co (11/4/2025)

Palmetto Clean Technology, Inc. of Charlotte, NC, acquired Cool Down Co of Sacramento, OR, strengthening its cooling solutions capabilities in the Pacific Northwest market.

92. UpSight Security Inc. (11/4/2025)

Arctic Wolf Networks, Inc. of Eden Prairie, MN, acquired UpSight Security Inc. of Beaverton, OR, strengthening its cybersecurity platform with advanced threat detection and security analytics capabilities.

93. Martinen LLC (11/20/2025)

Digital Insurance, LLC of Atlanta, GA, acquired Martinen LLC of La Pine, OR, strengthening its technology capabilities and expanding its presence in the Pacific Northwest insurance market.

94. Pavement Maintenance, Inc. (11/20/2025)

Sage Surface Partners of Dallas, TX, acquired Pavement Maintenance, Inc. of Portland, OR, expanding its geographic footprint in the Pacific Northwest pavement services market.

95. TES-Software, Inc. (11/25/2025)

Kev Group Inc. acquired TES-Software, Inc. of Cottage Grove, OR, strengthening its technology capabilities and software development portfolio.

96. Undisclosed Insurance Agency (12/1/2025)

Undisclosed Buyer acquired Undisclosed Insurance Agency, consolidating its presence in the insurance brokerage sector.

97. Galash Lawrence Inc (12/4/2025)

J.S. Held, LLC of Jericho, NY, acquired Galash Lawrence Inc of Bend, OR, reinforcing its forensic accounting and investigative services capabilities in the Pacific Northwest market.

98. Bright Wood Corporation (12/10/2025)

Andersen Corporation of Bayport, MN, acquired Bright Wood Corporation of Madras, OR, strengthening its wood products manufacturing capabilities and Pacific Northwest market presence.

99. Hunter Communications, Inc. (12/10/2025)

Oak Hill Capital Management, LLC of New York, NY, acquired Hunter Communications, Inc. of Central Point, OR, strengthening its portfolio of telecommunications and technology service providers.

100. Mushroom Madness, Inc. (12/10/2025)

FBC Holding, Inc. of Chandler, AZ, acquired Mushroom Madness, Inc. of Portland, OR, consolidating its position in the specialty food and fungi cultivation market.

101. Clearview Wealth Advisors, LLC (12/16/2025)

EP Wealth Advisors, LLC of Torrance, CA, acquired Clearview Wealth Advisors, LLC of Salem, OR, expanding its wealth management presence in the Pacific Northwest market.

102. Downstream LLC (12/18/2025)

Elevate Sports Ventures Inc. of New York, NY, acquired Downstream LLC of Portland, OR, strengthening its sports media and content capabilities in the Pacific Northwest market.

103. The Willamette Valley Company, LLC (12/18/2025)

Arclin, Inc. of Alpharetta, GA, acquired The Willamette Valley Company, LLC of Eugene, OR, strengthening its specialty chemicals and adhesives portfolio in the Pacific Northwest market.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence