2025 Year in Review | National M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

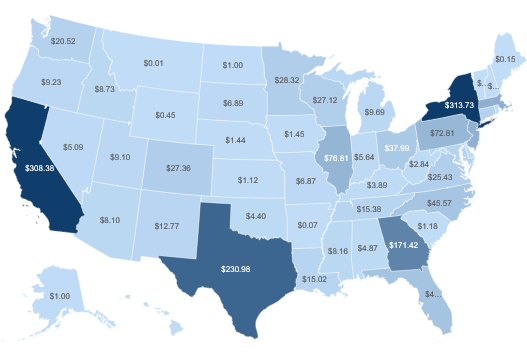

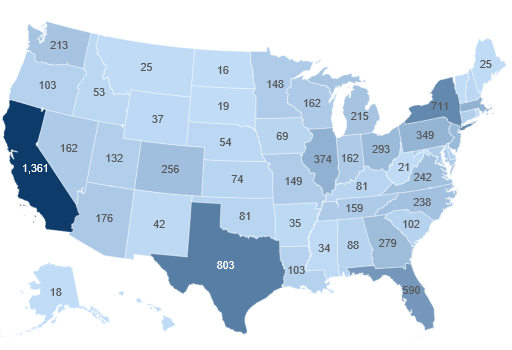

2025 - National Transaction Value ($bn) and Transaction Count

National M&A Overview: 2025

The U.S. M&A market in full-year 2025 (January 1 to December 31) closed with 15,880 disclosed transactions totaling approximately $2.26 trillion in disclosed value. The year was defined by a broad-based normalization in execution (more processes reaching signed outcomes), alongside a clear resurgence of megadeals that disproportionately lifted aggregate value.

Several transactions exemplified this “return of scale” dynamic, including Union Pacific’s ~$85B agreement to acquire Norfolk Southern (creating a coast-to-coast freight rail operator), Kimberly-Clark’s $40B agreement to acquire Kenvue, and Alphabet/Google’s $32B acquisition of Wiz (its largest-ever deal, aimed at strengthening Google Cloud’s security stack). Other notable large-format transactions included Global Payments’ $24.25B agreement to acquire Worldpay and Abbott’s up to ~$23B agreement to acquire Exact Sciences to expand cancer screening and precision diagnostics.

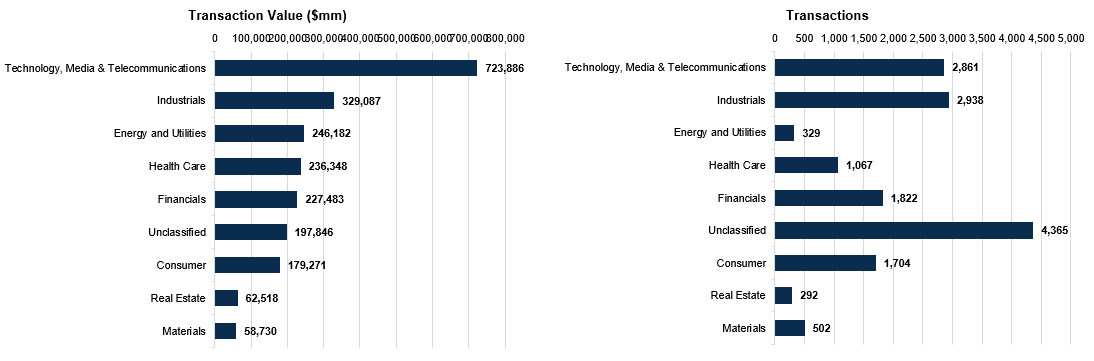

Sector Dynamics

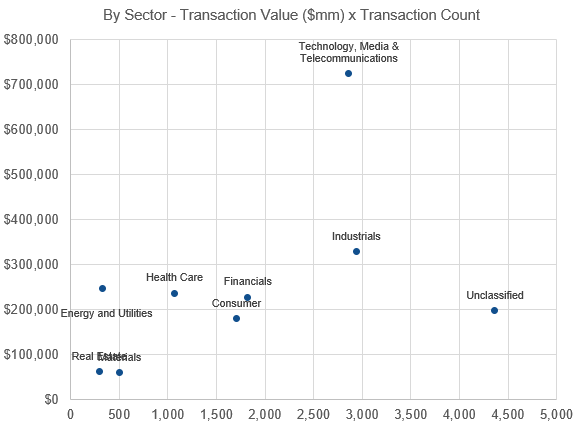

Technology, Media & Telecommunications (TMT) led the market with ~$723.9B of disclosed value across 2,861 transactions, reflecting sustained consolidation in cloud, cybersecurity, AI infrastructure, and software. A defining transaction was Google’s $32B acquisition of Wiz, signaling strategic urgency around cloud security as AI workloads scale across multi-cloud environments. Another major platform move was HPE’s ~$14B agreement to acquire Juniper Networks, reinforcing the market’s focus on secure, AI-enabled networking and next-generation infrastructure.

Industrials followed with ~$329.1B of value across 2,938 transactions, driven by logistics optimization, transportation network scale, and industrial-services consolidation. The year’s industrial headline transaction was Union Pacific’s ~$85B agreement to acquire Norfolk Southern, a combination aimed at reshaping U.S. freight routing and reducing handoffs across the national rail system—illustrative of the scale economics buyers sought in 2025.

Energy & Utilities generated ~$246.2B of disclosed value (329 transactions), supported by power generation, grid modernization, and infrastructure linked to rising electricity demand. The most prominent transaction was Constellation Energy’s $16.4B agreement to acquire Calpine, one of the largest U.S. power deals in years and a direct expression of investor conviction in dispatchable generation and customer platforms amid accelerating load growth.

Healthcare recorded ~$236.3B in value across 1,067 transactions, underscoring healthcare’s continued role as a “defensive growth” sector spanning diagnostics, tools, outsourced services, and scaled platforms. Notable deals included Abbott’s up to ~$23B acquisition of Exact Sciences (expanding into cancer screening and precision diagnostics) and Blackstone/TPG’s take-private of Hologic for up to ~$18.3B, highlighting sustained sponsor appetite for durable, scaled healthcare assets with multiple levers for operational improvement.

Financials totaled ~$227.5B across 1,822 transactions, driven by payments, fintech-enabled services, insurance platforms, and wealth/asset management consolidation. The anchor transaction was Global Payments’ $24.25B agreement to acquire Worldpay (paired with the divestiture of issuer solutions to FIS), reinforcing the premium placed on distribution, merchant scale, and operating leverage in payments ecosystems.

Consumer activity reached ~$179.3B across 1,704 transactions, with buyers pursuing both scale and portfolio repositioning amid shifting cost structures and consumer behavior. The standout transaction was Kimberly-Clark’s $40B agreement to acquire Kenvue, a rare mega-cap move in consumer-linked markets and a clear example of strategic repositioning toward higher-value, brand-driven categories.

Real Estate and Materials were active but more selective. 2025 saw a pickup in REIT M&A, including Rithm Capital’s acquisition of Paramount Group (reported as the largest equity REIT M&A transaction of the year, with deal value including debt assumption cited at ~$5.77B). In materials/specialty manufacturing, the year included major strategic combinations such as AkzoNobel’s ~$9.2B deal involving Axalta, creating a larger global coatings platform.

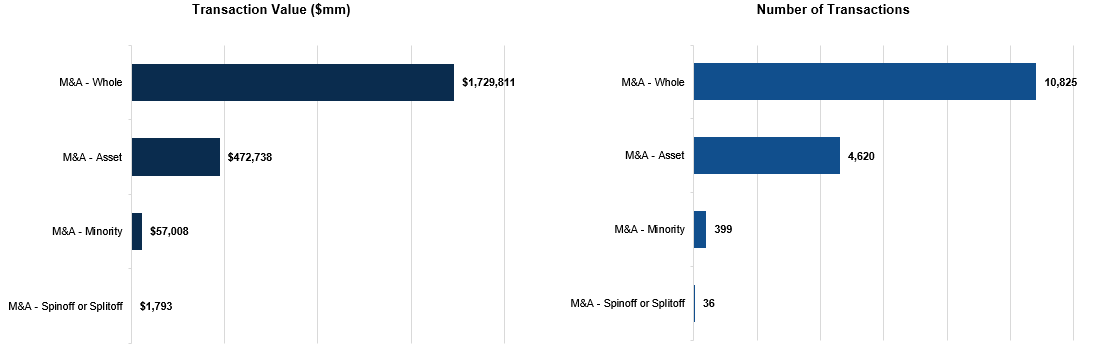

Transaction Structure and Buyer Composition

By structure, whole-company acquisitions dominated 2025, representing 10,825 transactions and ~$1.73T in disclosed value—evidence that buyers expressed conviction through outright control rather than incremental positioning. Asset acquisitions totaled 4,620 transactions and ~$472.7B, reflecting continued carve-outs, divestitures, and asset-heavy consolidation. Minority investments were comparatively smaller (399 transactions; ~$57.0B), with spinoffs/splitoffs limited (36 transactions; ~$1.8B).

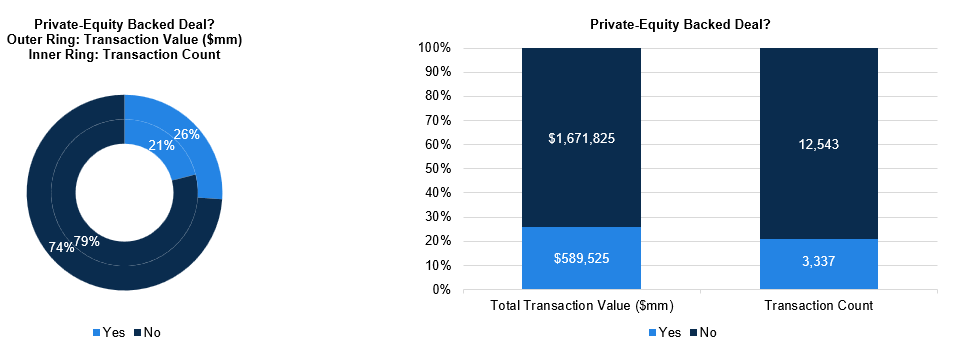

Private equity sponsors participated in 3,337 transactions (21% of total) and ~$589.5B of value (26% of total), reflecting re-accelerating deployment where underwriting could be supported by recurring revenue, pricing power, and operational levers—illustrated by large sponsor-backed outcomes like the Hologic take-private.

Geographic Concentration and Notable Regional Anchors

Deal activity remained concentrated in the country’s primary innovation and capital hubs. California led by transaction count (1,361 deals) and generated ~$308.4B in disclosed value, supported by technology and life sciences density (e.g., the Google/Wiz transaction, combining West Coast strategic scale with a high-growth security platform). New York captured the highest disclosed value (~$313.7B) with 711 transactions, reflecting financial services, media, and large-cap deal gravity. Texas recorded 803 deals and ~$231.0B in disclosed value, anchored by energy, industrials, and infrastructure-linked activity (including Calpine’s Houston footprint in the Constellation combination). Florida posted 590 transactions, continuing its rise as a major hub for services, healthcare platforms, and financial activity.

Outlook

In aggregate, 2025 confirmed a durable rebound in U.S. dealmaking, with normalized financing conditions, tighter bid-ask spreads, and a return of strategic conviction enabling both large-scale combinations and sustained middle-market throughput. Entering 2026, the market’s center of gravity remains in AI-enabled technology, digital infrastructure, power and grid modernization, scaled healthcare platforms, industrial/logistics networks, and payments, where long-duration demand and operating leverage continue to justify premium underwriting.

M&A Segmentation

Sector Breakdown:

Sponsor Activity:

M&A Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Copyright ©2026 William & Wall, S&P Global Market Intelligence