Q4 2025 | Montana M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

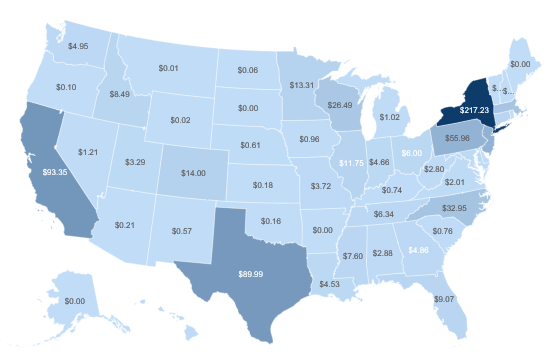

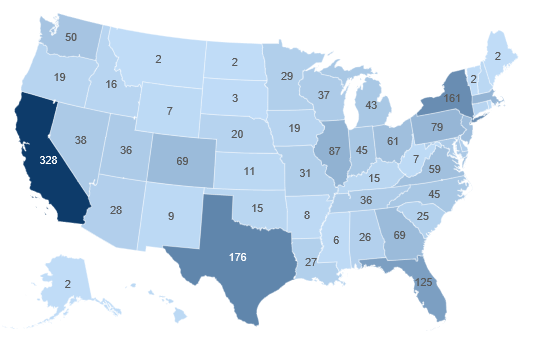

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Montana

Montana M&A Overview — Business Sale Activity for M&A Targets

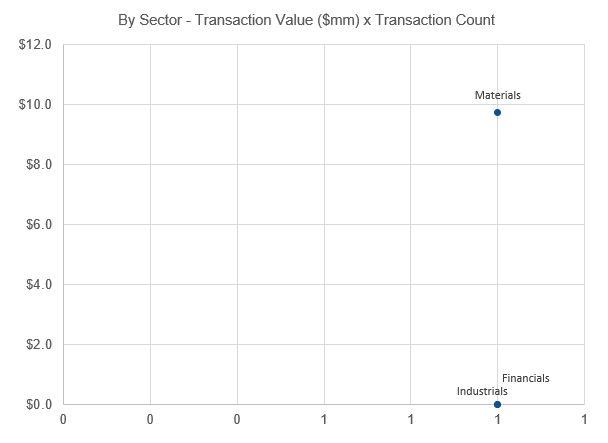

Montana’s Q4 2025 M&A activity highlighted continued consolidation across banking, natural resources, and infrastructure services—core pillars of the state’s economy. Security First Bank’s acquisition of eleven First Interstate Bank branches signaled ongoing regional banking consolidation and a strategic push to deepen market share across key Montana communities. In the resource sector, Almonty Industries’ $10 million acquisition of the Gentung Browns Lake Project underscored sustained investor appetite for domestic mineral assets tied to critical supply chains. Rounding out the quarter, Quanta Services’ purchase of Billings Flying Service strengthened its aerial infrastructure capabilities supporting utility and energy operations, reflecting broader capital deployment into grid modernization and field services. Collectively, Q4 transactions demonstrate that disciplined strategic buyers remain active in Montana, targeting durable cash-flowing assets and resource-linked platforms with long-term infrastructure relevance.

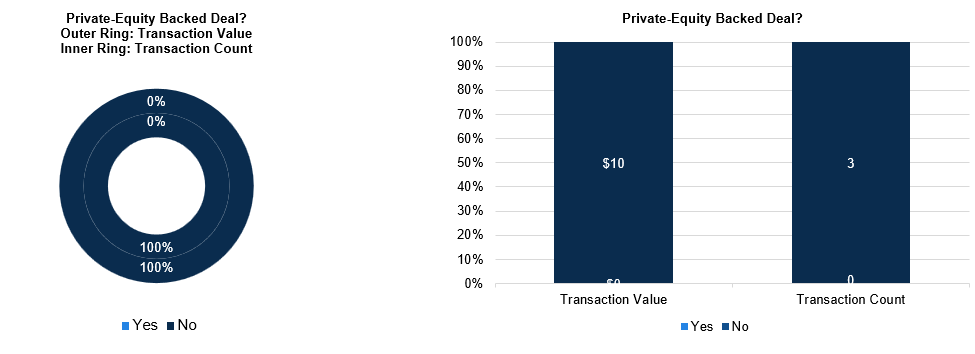

Montana — Strategic vs. Sponsor-led Activity

Montana — X / Y Plot By Sector

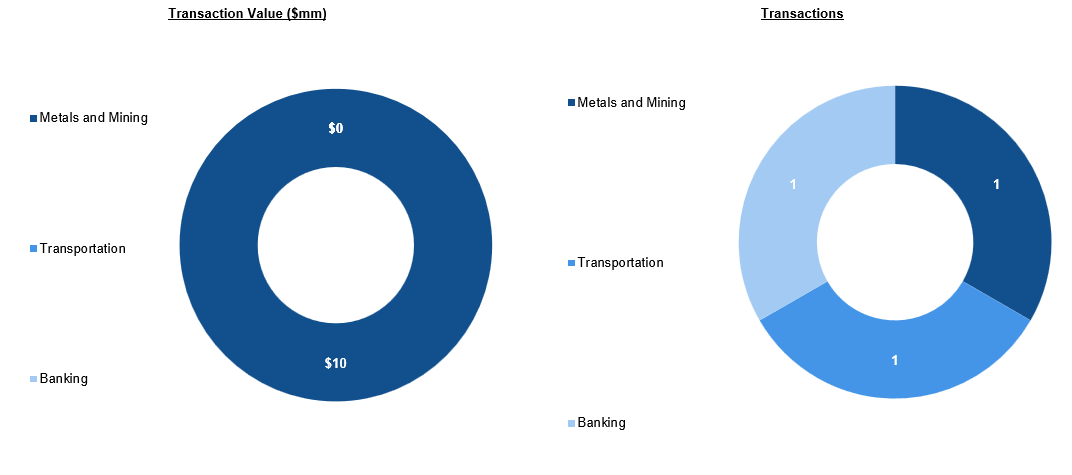

Montana — M&A Segmentation

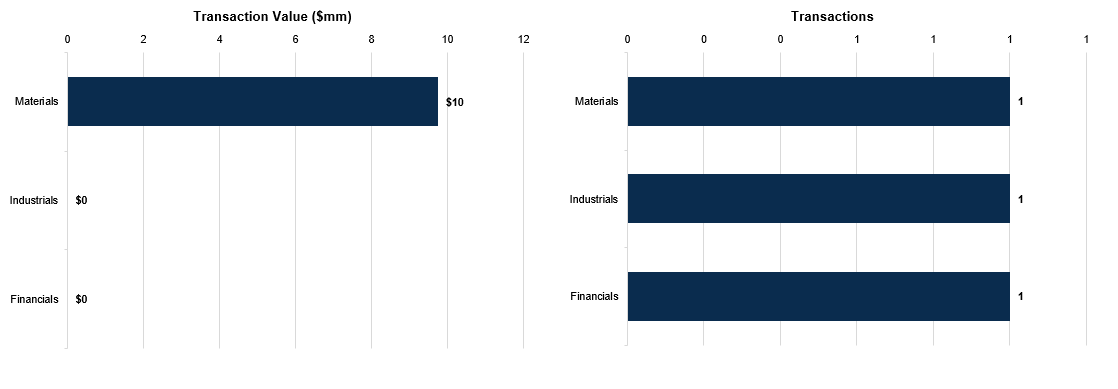

Montana — Sector Breakdown

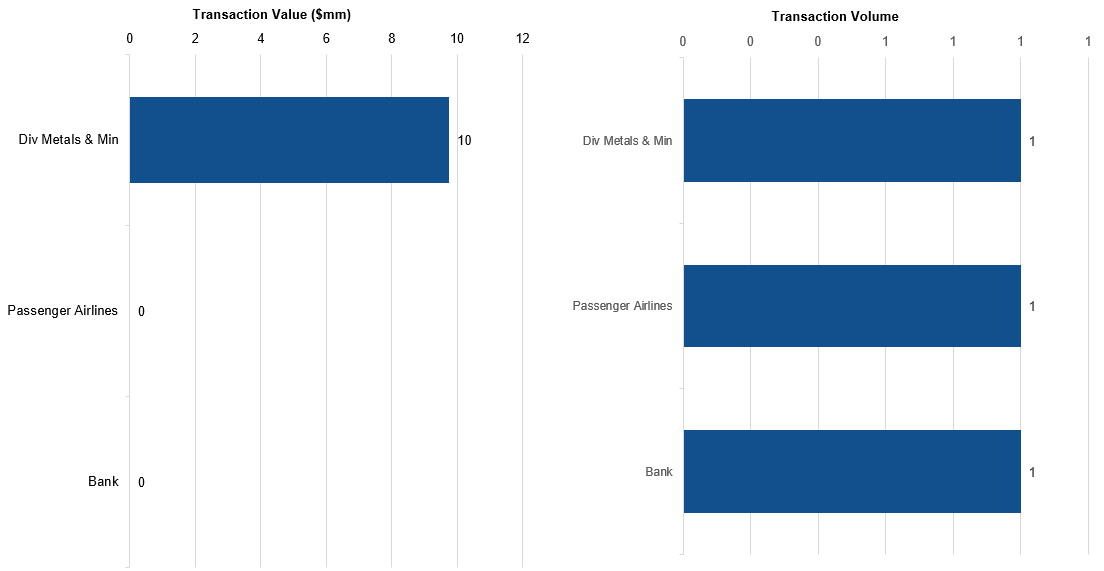

Second Level Primary Industry Breakdown

Montana M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Eleven branches of First Interstate Bank (10/16/2025)

Security First Bank of Lincoln, NE, acquired eleven branches of First Interstate Bank, consolidating its regional footprint and expanding market presence across key banking territories.

2. Gentung Browns Lake Project (10/28/2025)

Almonty Industries Inc. acquired Gentung Browns Lake Project for $10M, expanding its tungsten mining operations and mineral resource portfolio.

3. Billings Flying Service, Inc. (12/9/2025)

Quanta Services, Inc. of Houston, TX, acquired Billings Flying Service, Inc. of Billings, MT, strengthening its aerial infrastructure services capabilities for utility and energy sector operations.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence