2025 Year in Review | Montana M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

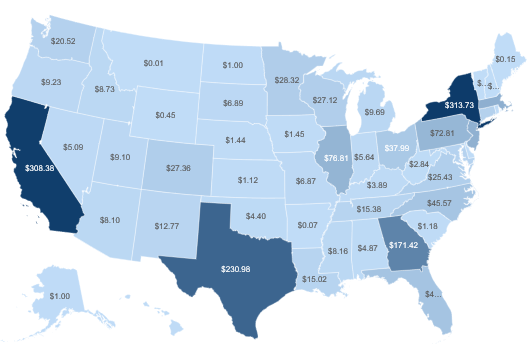

2025 - National Transaction Value ($bn) and Transaction Count

Targets in Montana

Montana M&A Overview — Business Sale Activity for M&A Targets

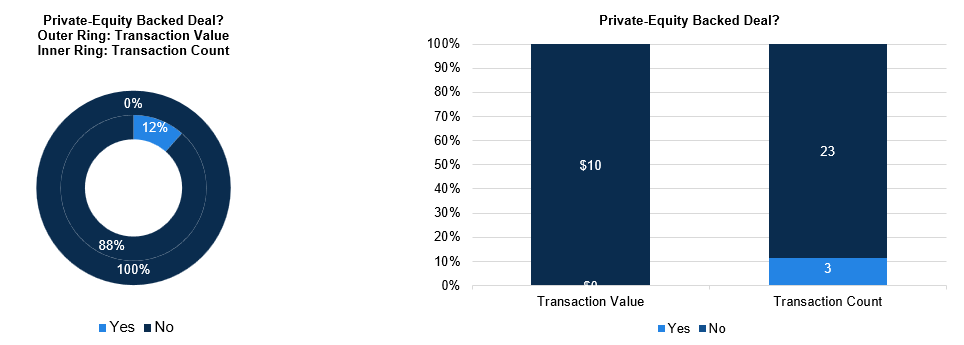

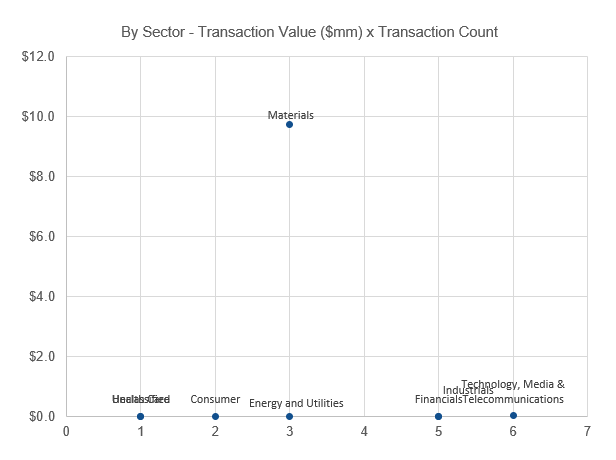

Montana’s 2025 M&A landscape reflected a steady expansion of institutional and strategic capital into the state’s core sectors—energy, natural resources, financial services, infrastructure, and technology. Early in the year, investor groups acquired both the Basin Creek Power Plant and Signal Peak Energy, underscoring continued appetite for power generation and coal-linked energy assets in the region. Mining and exploration activity remained active as well, with transactions such as Integral Metals Corp.’s acquisition of the Woods Creek Project, Magellan Copper and Gold Corp.’s purchase of the Cable Project, and Almonty Industries’ $10 million acquisition of the Gentung Browns Lake Project, highlighting Montana’s enduring role in the domestic minerals and metals supply chain. These deals signal sustained strategic interest in hard assets tied to U.S. energy security and resource independence.

Technology and digital infrastructure also featured prominently. Vagaro’s acquisition of Bozeman-based Schedulicity strengthened its salon and spa management software platform, while R.M. Young Company’s purchase of SensorLogic expanded environmental monitoring capabilities. Broadband and IT services saw continued consolidation, including Vero Broadband’s acquisition of Montana Digital and Visionary Communications’ purchase of A+ Computer Medic, reflecting rising demand for connectivity and outsourced technology support across the Mountain West. Fintech and ag-tech innovation added further depth, with transactions such as Okepay and Right Corporation demonstrating that Montana’s emerging technology ecosystem continues to attract out-of-state buyers seeking scalable platforms.

Community banking and financial services consolidation remained active throughout the year, including Frontier Credit Union’s acquisition of First Citizens Bank of Butte, Southwest Montana Community Federal Credit Union’s purchase of High Peaks Federal Credit Union, and Security First Bank’s acquisition of eleven First Interstate Bank branches. Insurance and advisory platforms also expanded their regional footprint, including Inszone Insurance Services’ acquisition of Rocky Mountain Insurance Group. Meanwhile, strategic buyers targeted essential services and infrastructure businesses, such as Republic Services’ acquisition of Silver Creek Ranch, Pye-Barker Fire & Safety’s expansion into Butte Security, and Quanta Services’ purchase of Billings Flying Service to strengthen aerial utility capabilities.

Collectively, 2025 demonstrated that Montana continues to attract disciplined strategic and financial buyers seeking durable cash-flowing assets, resource exposure, and technology-enabled growth platforms. For Montana business owners, the breadth of buyer interest—from infrastructure funds and mining groups to fintech acquirers and regional consolidators—signals a competitive environment where thoughtful preparation and positioning can translate into meaningful transaction outcomes.

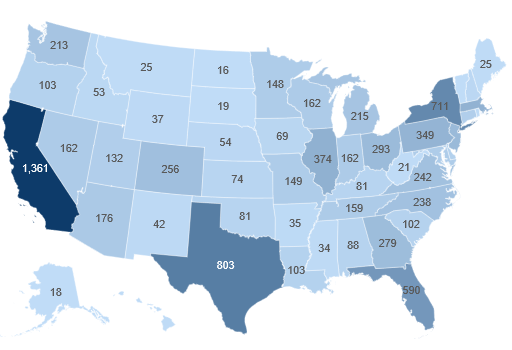

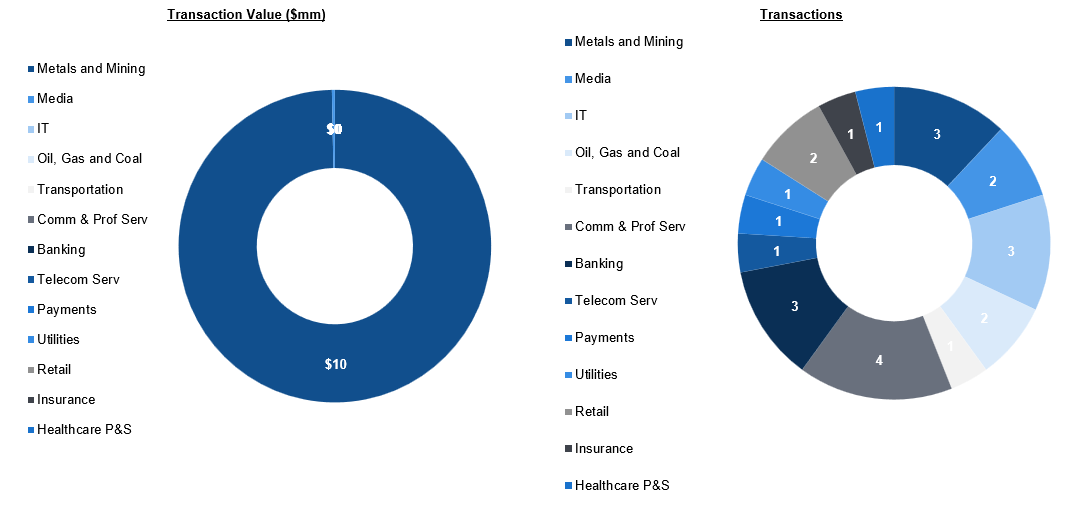

Montana — Strategic vs. Sponsor-led Activity

Montana — X / Y Plot By Sector

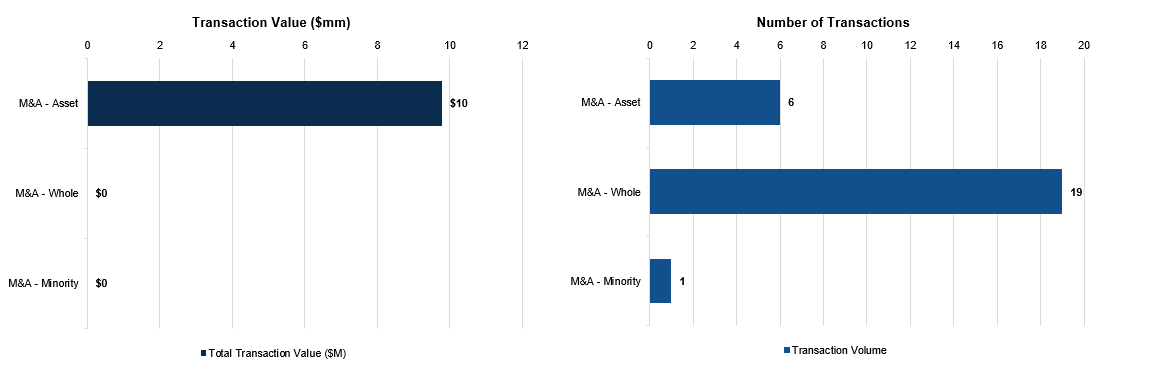

Montana — M&A Segmentation

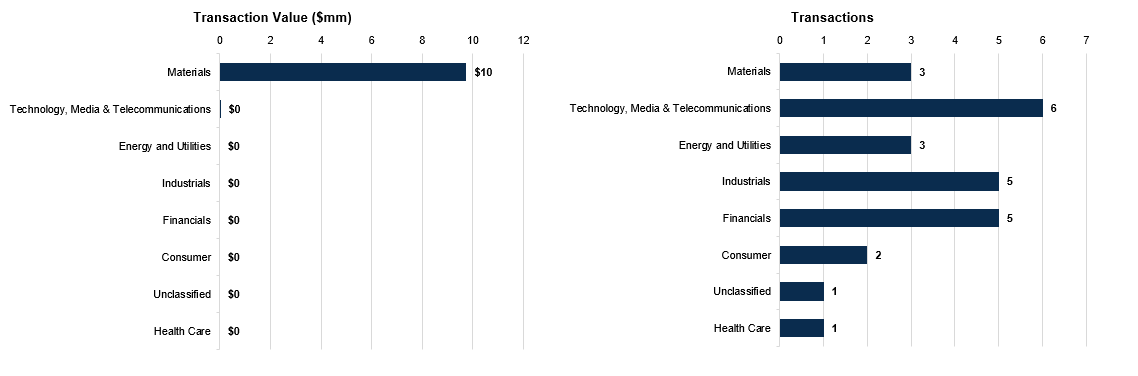

Montana — Sector Breakdown

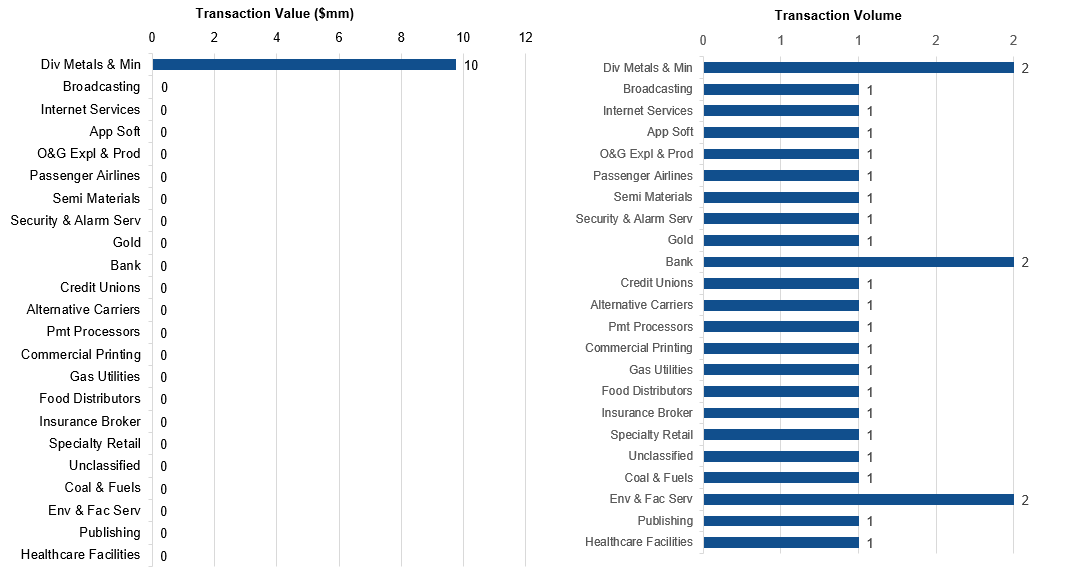

Second Level Primary Industry Breakdown

Montana M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Basin Creek Power Plant (1/9/2025)

Investor Group acquired Basin Creek Power Plant, expanding its energy generation portfolio and strengthening its position in the power infrastructure sector.

2. Schedulicity, Inc. (1/13/2025)

Vagaro, Inc. of Pleasanton, CA, acquired Schedulicity, Inc. of Bozeman, MT, consolidating its position in the salon and spa management software market.

3. SensorLogic, Inc. (1/17/2025)

R. M. Young Company of Traverse City, MI, acquired SensorLogic, Inc. of Bozeman, MT, strengthening its environmental monitoring and meteorological instrumentation capabilities.

4. Woods Creek Project in Montana (1/27/2025)

Integral Metals Corp. acquired Woods Creek Project in Montana, expanding its mineral exploration portfolio in the northwestern United States.

5. Cable Project (2/25/2025)

Magellan Copper and Gold Corp. of Wallace, ID, acquired Cable Project, expanding its mineral exploration portfolio and strengthening its position in the precious metals sector.

6. Montana Digital, LLC (3/4/2025)

Vero Broadband, LLC of Boulder, CO, acquired Montana Digital, LLC of Kalispell, MT, strengthening its fiber infrastructure and broadband service capabilities across the Mountain West region.

7. Butte Security TC LLC (3/31/2025)

Pye-Barker Fire & Safety, LLC of Alpharetta, GA, acquired Butte Security TC LLC of Butte, MT, expanding its fire protection and security services footprint into the Montana market.

8. A+ Computer Medic LLC (5/1/2025)

Visionary Communications, LLC of Gillette, WY, acquired A+ Computer Medic LLC of Whitehall, MT, expanding its technology services capabilities into the Montana market.

9. First Citizens Bank of Butte (5/1/2025)

Frontier Credit Union of Idaho Falls, ID, acquired First Citizens Bank of Butte of Butte, MT, expanding its geographic footprint into the Montana banking market.

10. Steel Etc (5/13/2025)

Pacific Steel & Recycling, Inc. of Great Falls, MT, acquired Steel Etc of Great Falls, MT, consolidating its local market presence and strengthening its steel processing capabilities.

11. High Peaks Federal Credit Union (5/19/2025)

Southwest Montana Community Federal Credit Union of Anaconda, MT, acquired High Peaks Federal Credit Union of Dillon, MT, consolidating its presence across southwestern Montana's rural banking market.

12. Western Montana Mental Health Center (5/28/2025)

A.W.A.R.E., Inc. of Anaconda, MT, acquired Western Montana Mental Health Center of Missoula, MT, expanding its behavioral healthcare services throughout the Montana region.

13. Vault Storyworks LLC (5/29/2025)

Aethon Books, LLC of Flower Mound, TX, acquired Vault Storyworks LLC of Missoula, MT, expanding its publishing portfolio and strengthening its content creation capabilities in the storytelling market.

14. Bozeman Frontage Road, Inc. (6/5/2025)

Covesion Limited acquired Bozeman Frontage Road, Inc. of Bozeman, MT, strengthening its North American operations and expanding its nonlinear optical crystal manufacturing footprint.

15. KTNY- FM (7/9/2025)

Hi-Line Radio Fellowship, Inc. of Havre, MT, acquired KTNY-FM for $0M, expanding its Christian broadcasting reach in the regional radio market.

16. PFL, Tech Inc. (7/9/2025)

Vomela Specialty Company of Saint Paul, MN, acquired PFL, Tech Inc. of Livingston, MT, strengthening its technology-driven printing and marketing solutions capabilities.

17. Signal Peak Energy, LLC (7/31/2025)

Investor Group acquired Signal Peak Energy, LLC of Roundup, MT, strengthening its position in the coal mining and energy production sector.

18. Rocky Mountain Insurance Group, LLC (8/19/2025)

Inszone Insurance Services, Inc of Rancho Cordova, CA, acquired Rocky Mountain Insurance Group, LLC of Bozeman, MT, strengthening its presence in the Mountain West insurance market.

19. Okepay Inc. (8/22/2025)

Readen Holding Corp. acquired Okepay Inc. of Kalispell, MT, strengthening its digital payment processing capabilities and expanding its fintech service offerings.

20. Silver Creek Ranch, Inc. (9/1/2025)

Republic Services, Inc. of Phoenix, AZ, acquired Silver Creek Ranch, Inc. of Helena, MT, expanding its waste management and environmental services footprint into the Montana market.

21. Right Corporation (9/4/2025)

StoneX Commodity Solutions LLC of Kansas City, MO, acquired Right Corporation of Bozeman, MT, strengthening its agricultural technology and commodity trading capabilities in the Rocky Mountain region.

22. PSI Propane (9/17/2025)

Valley Wide Cooperative, Inc. of Nampa, ID, acquired PSI Propane of Butte, MT, expanding its energy distribution footprint into the Montana propane market.

23. Advisr, Inc. (9/24/2025)

Veylan, Inc. of Huntington, NY, acquired Advisr, Inc. of Bozeman, MT, strengthening its advisory services capabilities and expanding its client servicing platform.

24. Eleven branches of First Interstate Bank (10/16/2025)

Security First Bank of Lincoln, NE, acquired eleven branches of First Interstate Bank, consolidating its regional footprint and expanding market presence across key banking territories.

25. Gentung Browns Lake Project (10/28/2025)

Almonty Industries Inc. acquired Gentung Browns Lake Project for $10M, expanding its tungsten mining operations and mineral resource portfolio.

26. Billings Flying Service, Inc. (12/9/2025)

Quanta Services, Inc. of Houston, TX, acquired Billings Flying Service, Inc. of Billings, MT, strengthening its aerial infrastructure services capabilities for utility and energy sector operations.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence