Q4 2025 | Washington M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

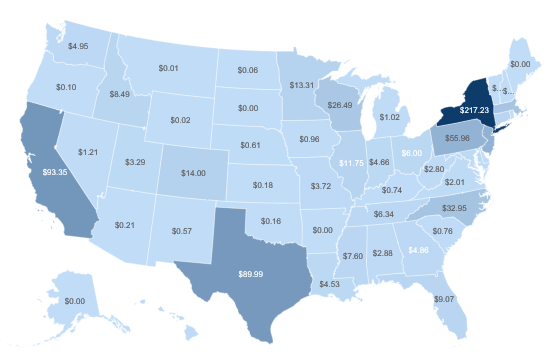

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Washington

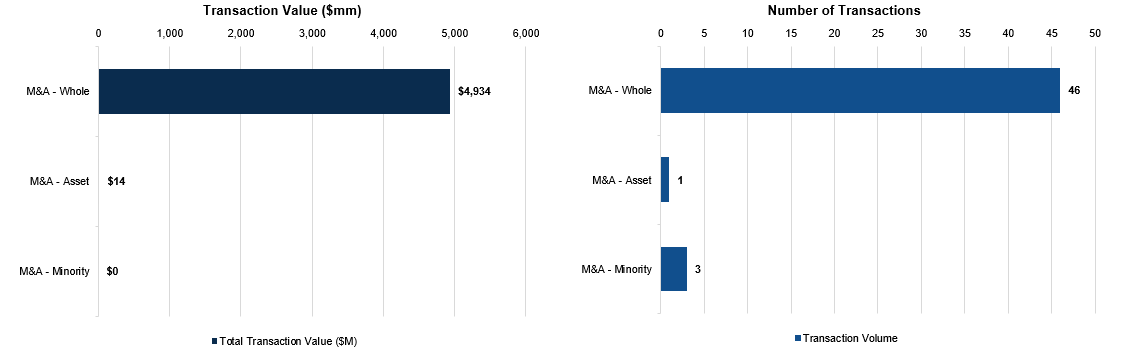

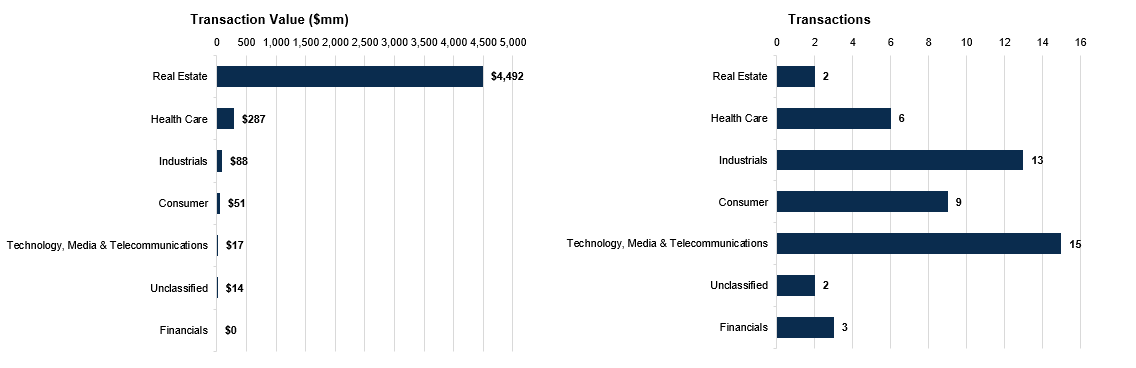

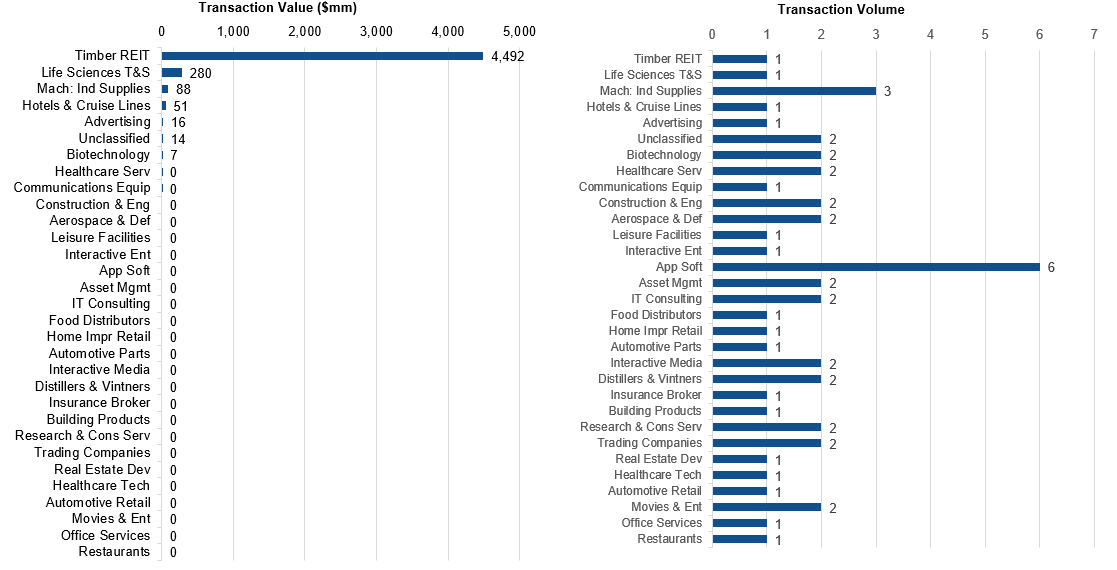

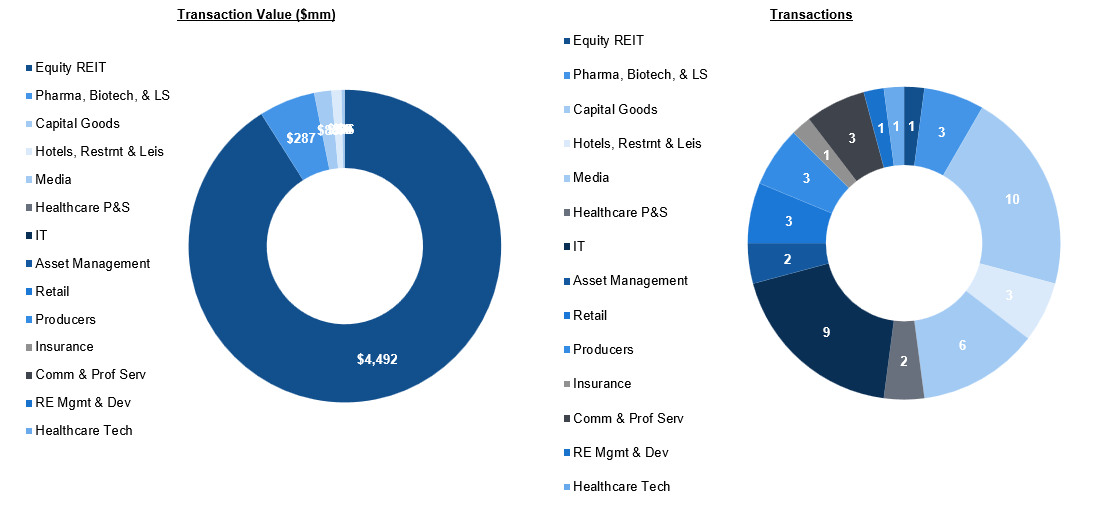

Washington M&A Overview — Business Sale Activity for M&A Targets

Washington’s Q4 2025 M&A market reflected broad-based strategic and financial buyer confidence, with 50 announced transactions spanning technology, advanced manufacturing, timber, professional services, and hospitality across the state. The quarter was anchored by Rayonier’s $4.49 billion acquisition of PotlatchDeltic Corporation in Spokane—one of the Pacific Northwest’s most significant timberland consolidations in recent years—underscoring continued institutional appetite for real asset platforms with long-duration cash flow profiles. At the same time, life sciences and technology remained active, highlighted by Qiagen’s $280 million acquisition of Seattle-based Parse Biosciences and Gong.io’s purchase of Rightbound in Kirkland, reinforcing Washington’s position as a national innovation hub in genomics, SaaS, and revenue intelligence.

Industrial and precision manufacturing transactions further demonstrated the durability of Washington’s middle market, with OmniMax acquiring Nu-Ray Metal Products in Puyallup, Karman Holdings purchasing Five Axis Industries in Arlington for $88 million, and multiple automation, aerospace, and composite manufacturing platforms changing hands throughout the quarter. Wealth management, insurance brokerage, legal services, and healthcare platforms also saw consolidation, including Corient’s acquisition of Bristlecone Advisors in Bellevue, Acrisure’s purchase of Kaye Associates in Puyallup, and PRISM Vision Group’s expansion into Spokane through the acquisition of Spokane Eye Clinic. Collectively, Q4 activity illustrates a balanced deal environment across Western Washington and the broader Pacific Northwest—where strategic buyers are pursuing capability expansion and geographic density, and private capital continues to target durable, cash-flowing businesses positioned for long-term regional growth.

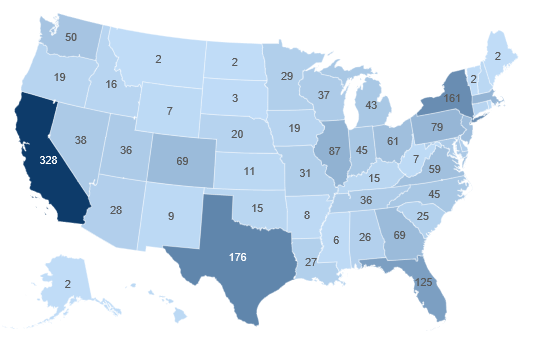

Washington — Strategic vs. Sponsor-led Activity

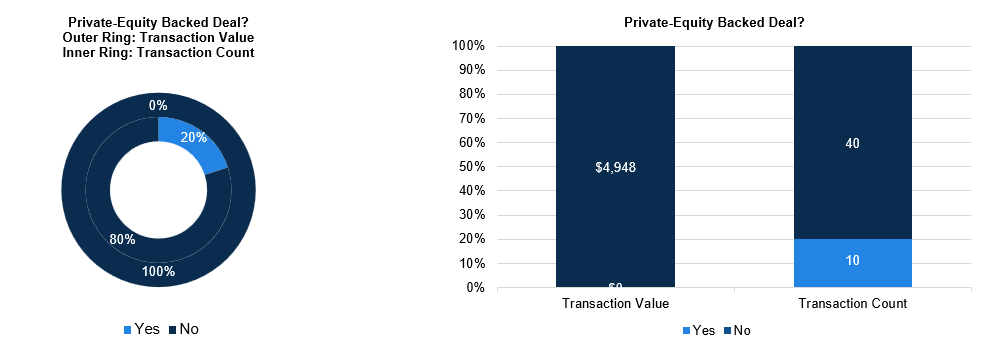

Washington — X / Y Plot By Sector

Washington — M&A Segmentation

Washington — Sector Breakdown

Second Level Primary Industry Breakdown

Washington M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Computer Service Corp and Network Solutions, LLC (10/1/2025)

FusionTek, Inc. of Kirkland, WA, acquired Computer Service Corp and Network Solutions, LLC of Seattle, WA, consolidating IT services and network infrastructure capabilities in the Pacific Northwest market.

2. Bristlecone Advisors LLC (10/2/2025)

Corient Private Wealth LLC of Miami, FL, acquired Bristlecone Advisors LLC of Bellevue, WA, expanding its wealth management presence in the Pacific Northwest market.

3. APSCO, LLC (10/3/2025)

DXP Enterprises, Inc. of Houston, TX, acquired APSCO, LLC of Redmond, WA, strengthening its industrial distribution capabilities in the Pacific Northwest market.

4. Marshall & Sullivan, Inc. (10/6/2025)

Highlands Residual Corporation of Seattle, WA, acquired Marshall & Sullivan, Inc. of Seattle, WA, consolidating local market presence and broadening its service capabilities within the Pacific Northwest region.

5. Trefethen and Co., Inc. (10/6/2025)

Cadogan Tate Group Limited acquired Trefethen and Co., Inc. of Seattle, WA, strengthening its Pacific Northwest logistics and specialized handling capabilities.

6. PotlatchDeltic Corporation (10/14/2025)

Rayonier Inc. of Yulee, FL, acquired PotlatchDeltic Corporation of Spokane, WA for $4,492M, consolidating its position as a leading timberland real estate investment trust with expanded forest holdings across the Pacific Northwest.

7. Electronic Systems Technology, Inc. (10/15/2025)

Lifeloc Technologies, Inc. of Wheat Ridge, CO, acquired Electronic Systems Technology, Inc. of Kennewick, WA for $0M, strengthening its breath alcohol testing and public safety technology capabilities.

8. MBS Source, LLC (10/16/2025)

Solve Advisors, Inc. of Stamford, CT, acquired MBS Source, LLC of Mercer Island, WA, consolidating its mortgage-backed securities advisory capabilities and Pacific Northwest market presence.

9. Seneca Real Estate Group, Inc. (10/17/2025)

Cumming Management Group, Inc. of Aliso Viejo, CA, acquired Seneca Real Estate Group, Inc. of Northfield, WA, consolidating its Pacific Northwest real estate services and development capabilities.

10. Nu-Ray Metal Products, Inc. (10/24/2025)

OmniMax International, Inc. of Peachtree Corners, GA, acquired Nu-Ray Metal Products, Inc. of Puyallup, WA, strengthening its metal fabrication capabilities and expanding its manufacturing footprint in the Pacific Northwest.

11. First Party Data (10/27/2025)

RAEK Data, LLC of Liberty Lake, WA, acquired First Party Data of Spokane, WA, consolidating its regional data analytics capabilities and client base.

12. Five Axis Industries Inc. (10/28/2025)

Karman Holdings Inc. of Huntington Beach, CA, acquired Five Axis Industries Inc. of Arlington, WA for $88M, strengthening its precision manufacturing capabilities and advanced machining operations.

13. Angeles Composite Technologies, Inc. (10/31/2025)

Port Angeles Composites acquired Angeles Composite Technologies, Inc. of Port Angeles, WA, consolidating local composite manufacturing capabilities and strengthening its position in the advanced materials sector.

14. Kaye Associates, LLC (10/31/2025)

Acrisure, LLC of Grand Rapids, MI, acquired Kaye Associates, LLC of Puyallup, WA, reinforcing its insurance brokerage platform in the Pacific Northwest market.

15. Triangle Pump & Equipment, Inc. (11/1/2025)

DXP Enterprises, Inc. of Houston, TX, acquired Triangle Pump & Equipment, Inc. of Ridgefield, WA, strengthening its industrial pump and equipment distribution capabilities in the Pacific Northwest.

16. Arena Sports, LLC (11/4/2025)

The Bay Clubs Company, LLC of San Francisco, CA, acquired Arena Sports, LLC of Redmond, WA, strengthening its premium fitness and recreational facilities portfolio in the Pacific Northwest market.

17. Parse Biosciences, Inc. (11/4/2025)

Qiagen N.V. acquired Parse Biosciences, Inc. of Seattle, WA for $280M, advancing its single-cell genomics capabilities and sample preparation technologies for life sciences research applications.

18. Dairy Distributing, Inc. (11/5/2025)

Odeko Inc. of New York, NY, acquired Dairy Distributing, Inc. of Bellingham, WA, strengthening its supply chain capabilities in the Pacific Northwest dairy distribution market.

19. Spokane Eye Clinic, PS (11/6/2025)

PRISM Vision Group of New Providence, NJ, acquired Spokane Eye Clinic, PS of Spokane, WA, expanding its ophthalmology platform into the Pacific Northwest market.

20. The 7on7 Association (11/6/2025)

Xtreme One Entertainment, Inc. of Grand Rapids, MI, acquired The 7on7 Association of Seattle, WA, advancing its position in youth football training and tournament management services.

21. Virginia Inn Seattle (11/6/2025)

Private Investor acquired Virginia Inn Seattle of Seattle, WA, expanding its hospitality portfolio in the Pacific Northwest market.

22. BoxedUp, Inc. (11/10/2025)

Incisive Computing Solutions, Inc. of Minneapolis, MN, acquired BoxedUp, Inc. of Seattle, WA, strengthening its software packaging and deployment capabilities in the Pacific Northwest market.

23. Curi Bio, Inc. (11/11/2025)

DreamCIS, Inc. acquired Curi Bio, Inc. of Seattle, WA, advancing its capabilities in biotechnology and cellular research solutions.

24. Big Fish Games, Inc. (11/12/2025)

Undisclosed Buyer acquired Big Fish Games, Inc. of Seattle, WA, strengthening its position in the casual gaming and interactive entertainment market.

25. Archenia, Inc. (11/13/2025)

Marchex, Inc. of Seattle, WA, acquired Archenia, Inc. of Seattle, WA for $16M, consolidating its call analytics and conversation intelligence capabilities within the local market.

26. The Seattle Seawolves (11/13/2025)

Private Investor acquired The Seattle Seawolves of Seattle, WA, expanding its sports entertainment portfolio in the professional rugby market.

27. Perkins Coie LLP (11/17/2025)

Ashurst LLP acquired Perkins Coie LLP of Seattle, WA, strengthening its U.S. legal presence and expanding technology and intellectual property capabilities in the Pacific Northwest market.

28. Spiral Technologies Inc. (11/18/2025)

UJET, Inc. of San Francisco, CA, acquired Spiral Technologies Inc. of Seattle, WA, reinforcing its cloud-based contact center platform with advanced customer engagement capabilities.

29. Systems For Public Safety Inc. (11/24/2025)

Lehr Upfitters, LLC of Reno, NV, acquired Systems For Public Safety Inc. of Lakewood, WA, strengthening its emergency vehicle upfitting capabilities and expanding its geographic reach in the Pacific Northwest public safety market.

30. Sea-Western, Inc. (11/25/2025)

Municipal Emergency Services, Inc. of Sandy Hook, CT, acquired Sea-Western, Inc. of Kirkland, WA, expanding its emergency response capabilities and geographic footprint across the Pacific Northwest.

31. Lamar Technologies LLC (12/1/2025)

Hartzell Engine Technologies, LLC of Montgomery, AL, acquired Lamar Technologies LLC of Marysville, WA, strengthening its aerospace technology capabilities and expanding its Pacific Northwest manufacturing footprint.

32. Rightbound, Inc. (12/2/2025)

Gong.io Ltd. acquired Rightbound, Inc. of Kirkland, WA, strengthening its revenue intelligence platform with advanced sales engagement capabilities.

33. UST Training, Inc. (12/2/2025)

360training.com, Inc. of Austin, TX, acquired UST Training, Inc. of Langley, WA, strengthening its online training platform with specialized safety and compliance capabilities.

34. A.A.R. Testing Laboratories, Inc. (12/3/2025)

HOLDING SOCOTEC - S.A.S. acquired A.A.R. Testing Laboratories, Inc. of Redmond, WA, strengthening its technical testing and inspection capabilities in the Pacific Northwest market.

35. HOS Bros. Construction, Inc. (12/3/2025)

Joshua Green Corporation of Seattle, WA, acquired HOS Bros. Construction, Inc. of Woodinville, WA, strengthening its construction capabilities in the Pacific Northwest market.

36. Neuro Elite Athletics LLC (12/3/2025)

Control Bionics Ngage Inc. acquired Neuro Elite Athletics LLC of Kirkland, WA for $0M, advancing its neurotechnology capabilities in sports performance and athletic training applications.

37. Secure, Inc. (12/4/2025)

State Bank of Howards Grove of Sheboygan, WI, acquired Secure, Inc. of Kirkland, WA, strengthening its cybersecurity and technology infrastructure capabilities.

38. Ste. Michelle Wine Estates Ltd. (12/4/2025)

Undisclosed Buyer acquired Ste. Michelle Wine Estates Ltd. of Woodinville, WA, consolidating its position in the premium Pacific Northwest wine market.

39. Gatehouse Brands (12/5/2025)

Evergreen Family Wines of Prosser, WA, acquired Gatehouse Brands of Redmond, WA, expanding its portfolio of wine and beverage brands across the Pacific Northwest market.

40. Hexas Biomass Inc. (12/8/2025)

Bioleum Corporation of Carson City, NV, acquired Hexas Biomass Inc. of Olympia, WA for $7M, strengthening its renewable energy capabilities and biomass processing operations.

41. Automated Systems of Tacoma, LLC (12/9/2025)

Marchesini Group S.p.A. acquired Automated Systems of Tacoma, LLC of Tacoma, WA, strengthening its North American automation capabilities and expanding its packaging machinery solutions portfolio.

42. Starling Solutions, Inc. (12/9/2025)

Handspring Health, Inc. of Jersey City, NJ, acquired Starling Solutions, Inc. of Seattle, WA, strengthening its healthcare technology capabilities and expanding its geographic presence in the Pacific Northwest.

43. The Huntington (12/9/2025)

Mentis Capital Partners of Salisbury, MD, acquired The Huntington for $14M, strengthening its portfolio of hospitality and real estate assets.

44. Confiz LLC (12/11/2025)

Systems Limited acquired Confiz LLC of Bellevue, WA, strengthening its software development and digital transformation capabilities in the North American market.

45. CropCore (12/12/2025)

Insure.ag of East Wenatchee, WA, acquired CropCore of East Wenatchee, WA, consolidating agricultural technology and insurance services within the regional farming sector.

46. Dewaard & Bode, Inc. (12/16/2025)

Kodiak Interiors Group of Englewood, CO, acquired Dewaard & Bode, Inc. of Bellingham, WA, strengthening its interior design and construction capabilities in the Pacific Northwest market.

47. Everything Legal, LLC (12/17/2025)

a360inc of San Antonio, TX, acquired Everything Legal, LLC of Seattle, WA, strengthening its legal technology and services capabilities in the Pacific Northwest market.

48. SpringHill Suites Seattle Downtown/South Lake Union (12/17/2025)

Legacy Development & Management, LLC of Albuquerque, NM, acquired SpringHill Suites Seattle Downtown/South Lake Union of Seattle, WA for $51M, positioning the firm in Seattle's high-demand tech corridor hospitality market.

49. Egis Group LLC (12/18/2025)

Patrick Industries, Inc. of Elkhart, IN, acquired Egis Group LLC of Bellingham, WA, strengthening its manufacturing capabilities and expanding its geographic footprint in the Pacific Northwest.

50. North Star Tax & Accounting (12/29/2025)

Capstone Certified Public Accountants, LLC of Bend, OR, acquired North Star Tax & Accounting of Snohomish, WA, expanding its Pacific Northwest footprint and strengthening its tax preparation and accounting services capabilities.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence