Q4 2025 | Nevada M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

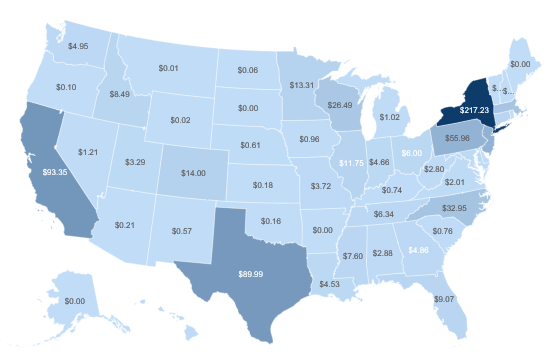

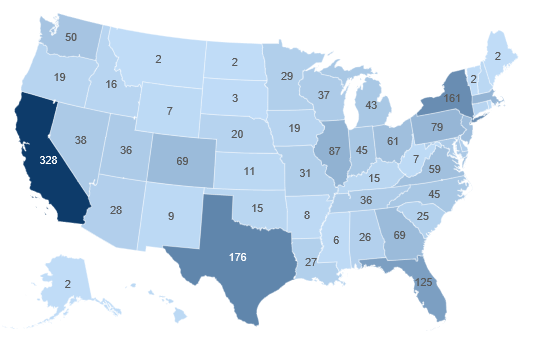

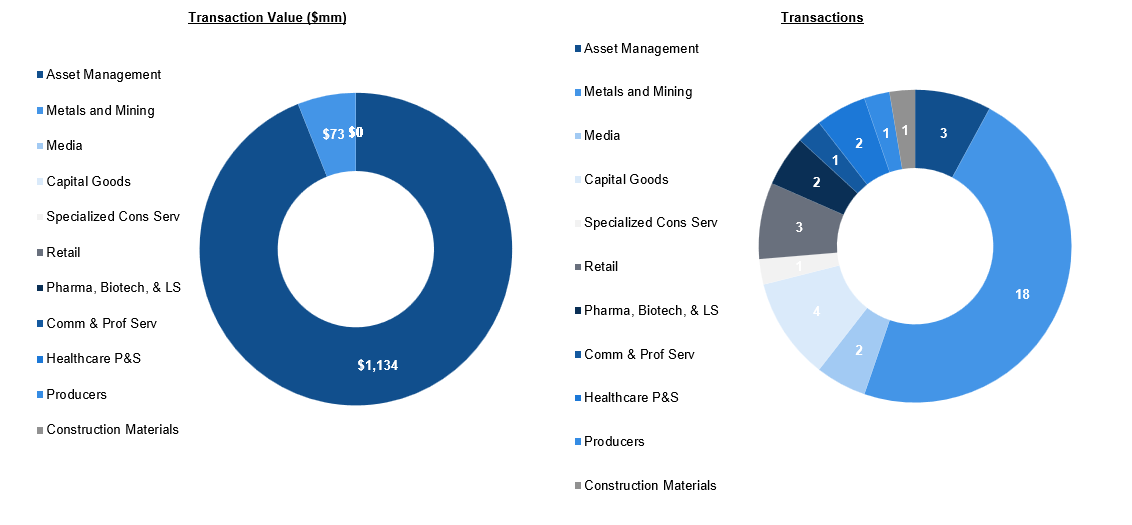

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Nevada

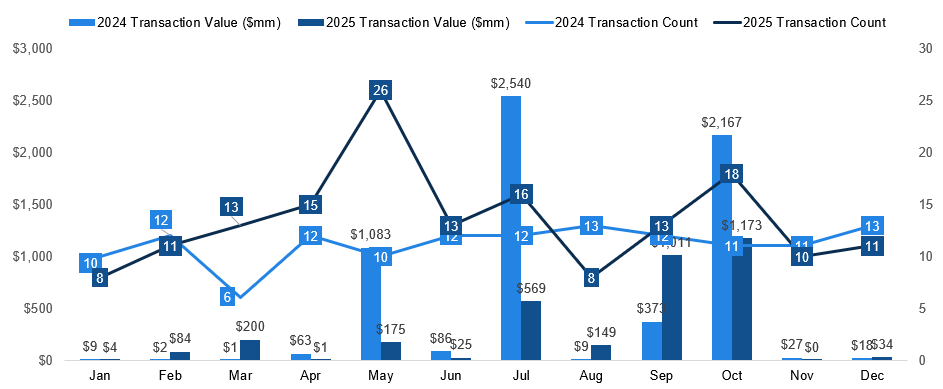

Nevada - Transaction Value and Count by Month

Nevada — Business Sale Overview

Q4 2025 marked a robust and strategically diverse period for Nevada M&A activity, underscoring the state’s continued importance across construction, natural resources, healthcare, and capital markets. Strategic buyers were particularly active in building products and infrastructure, highlighted by Builders FirstSource, Inc.’s acquisitions of Builders Door & Trim LLC and Rystin Construction, Inc., reinforcing its millwork and specialty construction footprint across the Las Vegas and Henderson markets. Distribution and industrial consolidation remained strong as US Foods Holding Corp. expanded its Nevada foodservice presence and Watts Water Technologies, Inc. acquired Haws Corporation in Sparks, further signaling confidence in the region’s commercial and municipal infrastructure demand.

Mining and critical minerals dominated overall deal volume and capital deployment, with transactions spanning gold, silver, lithium, nickel, and tungsten assets across Nevada’s prolific resource corridors, including large-scale capital markets activity such as ONE Nuclear Energy’s $1.13 billion acquisition of Hennessy Capital Investment Corp. VII in Zephyr Cove. From precious metals platforms like Sprott Mining’s acquisition of Hycroft Mining in Winnemucca to multiple lithium and royalty transactions tied to battery metal demand, Q4 activity reflected sustained investor conviction in Nevada’s strategic role in domestic resource development. Complementing this trend were healthcare and specialty services expansions—including infusion therapy, fire protection, and regional healthcare network acquisitions—demonstrating that both strategic and financial buyers continue to view Nevada as a compelling growth market supported by population inflows, infrastructure investment, and long-term energy transition themes.

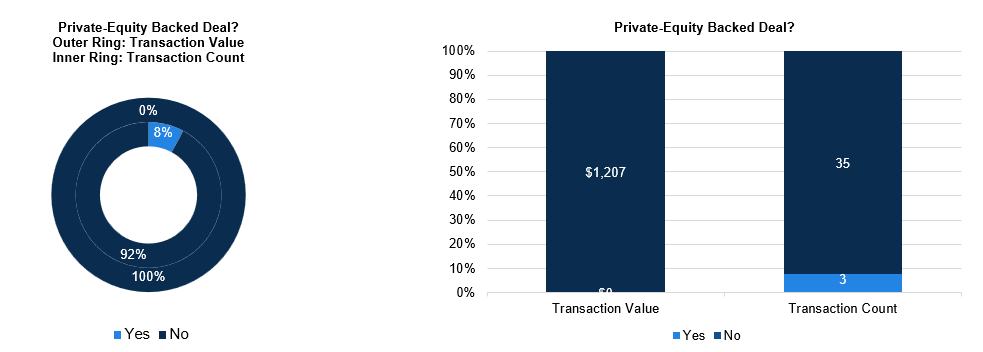

Nevada — Strategic vs. Sponsor-led Activity

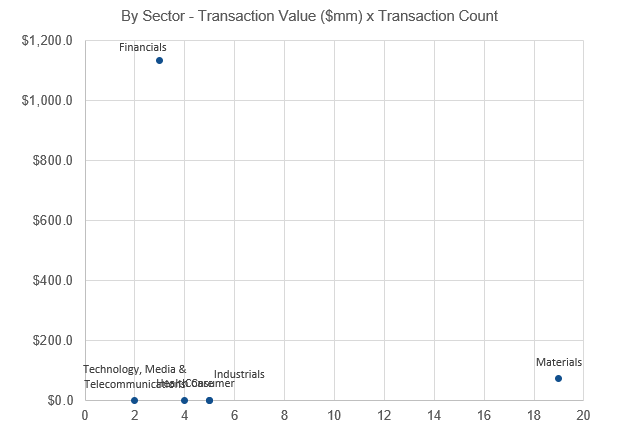

Nevada — X / Y Plot By Sector

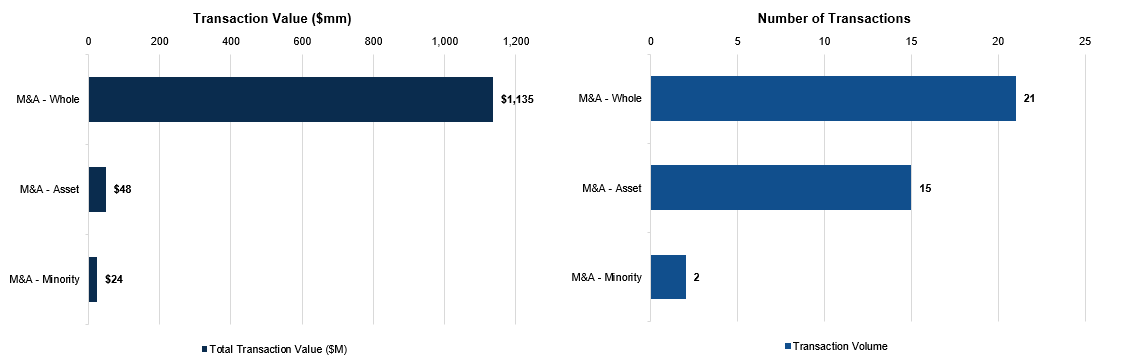

Nevada — M&A Segmentation

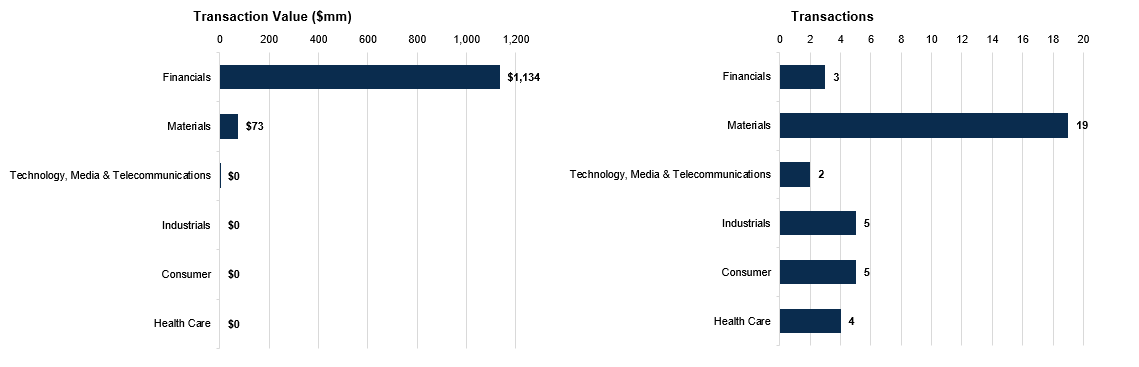

Nevada — Sector Breakdown

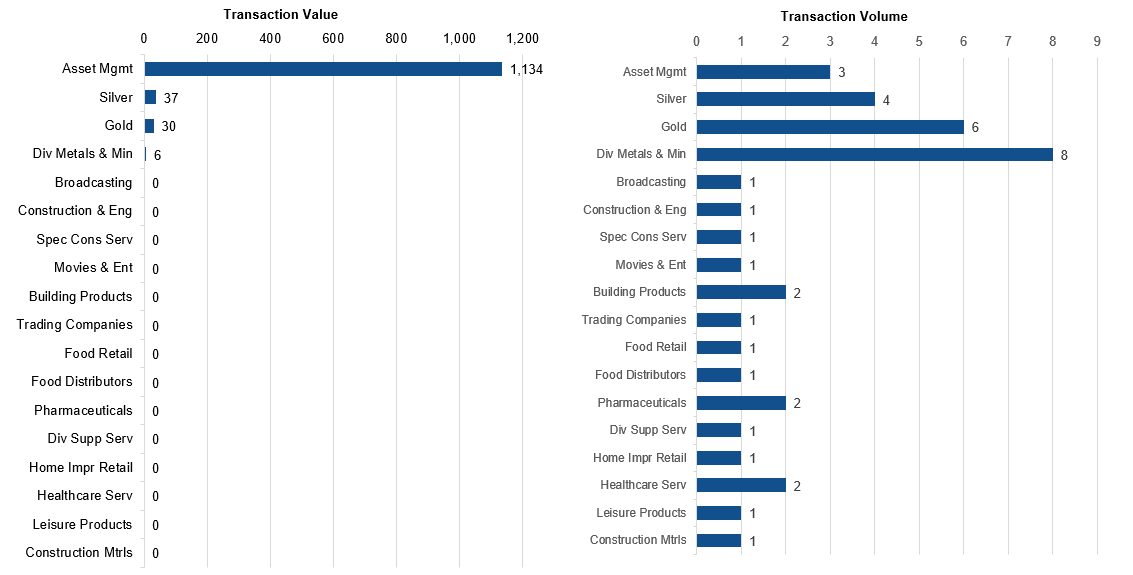

Second Level Primary Industry Breakdown

Nevada M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Builders Door & Trim LLC (10/1/2025)

Builders FirstSource, Inc. of Irving, TX, acquired Builders Door & Trim LLC of Las Vegas, NV, expanding its millwork and specialty building products capabilities in the Nevada market.

2. Mountain Lake Acquisition Corp. (10/1/2025)

Avalanche Treasury Corporation acquired Mountain Lake Acquisition Corp. of Incline Village, NV, strengthening its investment vehicle platform and expanding its presence in Nevada's financial services market.

3. Rystin Construction, Inc. (10/1/2025)

Builders FirstSource, Inc. of Irving, TX, acquired Rystin Construction, Inc. of Henderson, NV, consolidating its presence in the Nevada construction market.

4. Spanish Moon Project (10/1/2025)

Kinross Gold Corporation acquired Spanish Moon Project, expanding its gold mining portfolio and development pipeline.

5. Green Valley Grocery, Inc. (10/3/2025)

Anabi Oil Corporation of Upland, CA, acquired Green Valley Grocery, Inc. of Las Vegas, NV, expanding its retail footprint beyond traditional petroleum operations into the grocery sector.

6. Vegas Stone Brokers LLC (10/3/2025)

Pool Corporation of Covington, LA, acquired Vegas Stone Brokers LLC of Las Vegas, NV, expanding its hardscape and decorative stone offerings for the pool and outdoor living market.

7. Cinderlite Trucking Corp. (10/6/2025)

Centennial Aggregate Inc acquired Cinderlite Trucking Corp. of Carson City, NV, consolidating its transportation and logistics capabilities in the Western materials distribution market.

8. Firenze Gold Project (10/14/2025)

Altitude Minerals Ltd acquired Firenze Gold Project for $0.43M, expanding its precious metals exploration portfolio in the gold mining sector.

9. Springer Ball Mine (10/14/2025)

Blue Moon Metals Inc. acquired Springer Ball Mine for $0.5M, expanding its mineral extraction operations and production capacity.

10. Vitalibis, Inc. (10/14/2025)

Zhejiang Bayi Electronics Technology Co., Ltd. acquired Vitalibis, Inc. of Las Vegas, NV, advancing its presence in the North American health technology market.

11. Baughman & Turner, Inc. (10/15/2025)

CivilOne of Las Vegas, NV, acquired Baughman & Turner, Inc. of Las Vegas, NV, consolidating local engineering and construction capabilities within the Nevada market.

12. Three Lithium Properties and Other Assets (10/17/2025)

ExGen Resources Inc. acquired Three Lithium Properties and Other Assets for $1.73M, positioning itself in the critical battery metals sector amid growing electric vehicle demand.

13. Mining Claims (10/22/2025)

Investmin Resources Inc. acquired Mining Claims for $35M, expanding its mineral asset portfolio and strengthening its position in the natural resources sector.

14. Hennessy Capital Investment Corp. VII (10/23/2025)

ONE Nuclear Energy LLC of Palm Beach, FL, acquired Hennessy Capital Investment Corp. VII of Zephyr Cove, NV for $1,134.42M, positioning the company to accelerate its clean energy development initiatives through enhanced capital market access.

15. Borroka LLC (10/28/2025)

Xtreme Fighting Championships, Inc. of Miramar Beach, FL, acquired Borroka LLC of Las Vegas, NV, consolidating its mixed martial arts promotion capabilities in key combat sports markets.

16. Berto Acquisition Corp. (10/29/2025)

MD Health RX Solutions, LLC of Tampa, FL, acquired Berto Acquisition Corp. of Las Vegas, NV, expanding its pharmaceutical services footprint into the Nevada market.

17. Carlin Queen Gold and Silver Project (10/30/2025)

Fairchild Gold Corp. acquired Carlin Queen Gold and Silver Project for $0.83M, expanding its precious metals mining portfolio and strengthening its position in Nevada's prolific Carlin Trend gold district.

18. Sdmi Limited Partnership (10/30/2025)

Intermountain Health Care, Inc. of Salt Lake City, UT, acquired Sdmi Limited Partnership of Las Vegas, NV, expanding its healthcare delivery network into the Nevada market.

19. Haws Corporation (11/4/2025)

Watts Water Technologies, Inc. of North Andover, MA, acquired Haws Corporation of Sparks, NV, strengthening its portfolio of water safety and emergency equipment solutions.

20. Jim L. Shetakis Distributing Co. (11/6/2025)

US Foods Holding Corp. of Rosemont, IL, acquired Jim L. Shetakis Distributing Co. of North Las Vegas, NV, reinforcing its foodservice distribution network in the Nevada market.

21. One World Products, Inc. (11/6/2025)

Management Group acquired One World Products, Inc. of Las Vegas, NV, consolidating its position in the consumer products sector.

22. Total Infusion Care LLC (11/7/2025)

BioMatrix Specialty Pharmacy, LLC of Plantation, FL, acquired Total Infusion Care LLC of Henderson, NV, expanding its specialized infusion therapy services into the Nevada market.

23. Red E Fire Protection Services LLC (11/14/2025)

Pye-Barker Fire & Safety, LLC of Alpharetta, GA, acquired Red E Fire Protection Services LLC of North Las Vegas, NV, expanding its fire protection services footprint into the Nevada market.

24. South Cortez and Tonkin Property (11/17/2025)

Palisades Goldcorp Ltd. acquired South Cortez and Tonkin Property, expanding its gold mining asset portfolio in strategic Nevada locations.

25. American Lithium Minerals, Inc. (11/21/2025)

Worldwide Diversified Holdings, Inc. of Dover, DE, acquired American Lithium Minerals, Inc. of Las Vegas, NV, positioning itself in the critical battery metals sector amid growing electric vehicle demand.

26. Nevada Hills Gold LLC (11/24/2025)

Americore Resources Corp. acquired Nevada Hills Gold LLC of Las Vegas, NV for $0.31M, expanding its precious metals mining operations in the Nevada gold belt.

27. Two Tv stations (11/25/2025)

King Forward, Inc. of Sunrise, FL, acquired Two Tv stations for $0.14M, expanding its media broadcasting footprint in the television market.

28. 2% NSR royalty on Mt. Hamilton Project (11/26/2025)

Sailfish Royalty Corp. acquired 2% NSR royalty on Mt. Hamilton Project, expanding its portfolio of mining royalty assets.

29. Hycroft Mining Holding Corporation (12/3/2025)

Sprott Mining Inc. acquired Hycroft Mining Holding Corporation of Winnemucca, NV for $24.11M, consolidating its precious metals mining operations in Nevada's established gold and silver district.

30. Silver Park claims (12/3/2025)

Nevada King Gold Corp. acquired Silver Park claims for $0.09M, expanding its mineral exploration portfolio and strengthening its position in precious metals development.

31. Blu Car Wash (12/5/2025)

WOW Wash Midco II LLC of Las Vegas, NV, acquired Blu Car Wash, strengthening its car wash portfolio and expanding its geographic footprint in the automated vehicle cleaning market.

32. Corcoran Canyon Property (12/8/2025)

Undisclosed Buyer acquired Corcoran Canyon Property, expanding its real estate portfolio in the canyon property development sector.

33. Keystone Project (12/9/2025)

Summit Minerals Limited acquired Keystone Project for $1.64M, expanding its mineral exploration portfolio and strengthening its resource development capabilities.

34. Gold Point Project (12/11/2025)

Nelson Resources Limited acquired Gold Point Project for $4.84M, expanding its precious metals exploration portfolio and strengthening its position in the gold mining sector.

35. Six Tungsten Projects (12/15/2025)

Viking Mines Limited acquired Six Tungsten Projects for $2.9M, expanding its critical metals portfolio and strengthening its position in the strategic tungsten mining sector.

36. Sports Attack, LLC (12/15/2025)

Sound Growth Partners of Edmonds, WA, acquired Sports Attack, LLC of Verdi, NV, strengthening its portfolio of sports training and equipment businesses.

37. Ecru Property (12/17/2025)

Québec Nickel Corp. acquired Ecru Property for $0.39M, advancing its mineral exploration portfolio and strategic land position in the nickel sector.

38. Mustang Property (12/18/2025)

Black Mammoth Metals Corporation acquired Mustang Property, expanding its mineral exploration and development portfolio in the metals sector.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence