Q4 2025 | Idaho M&A Insights

The information reflects transactions as reported, including deal descriptions, values, and statuses, but may contain gaps, such as undisclosed deal terms or financial metrics, which limit comprehensive analysis. While efforts have been made to ensure accuracy, users should consult primary sources or professional advisors for legal, financial, or strategic decisions. No warranties are made regarding the completeness or reliability of this data, and the provider assumes no liability for its use.

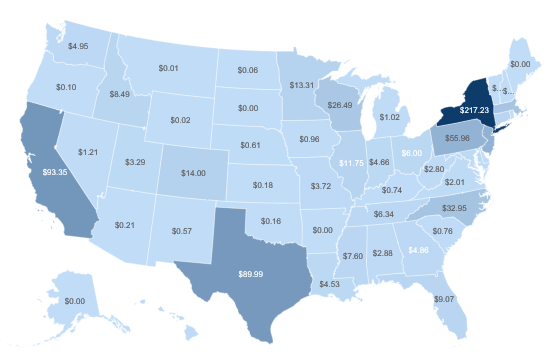

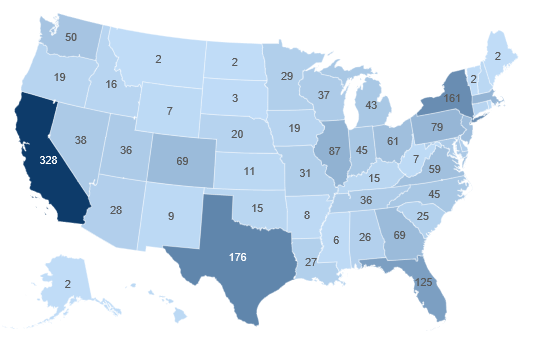

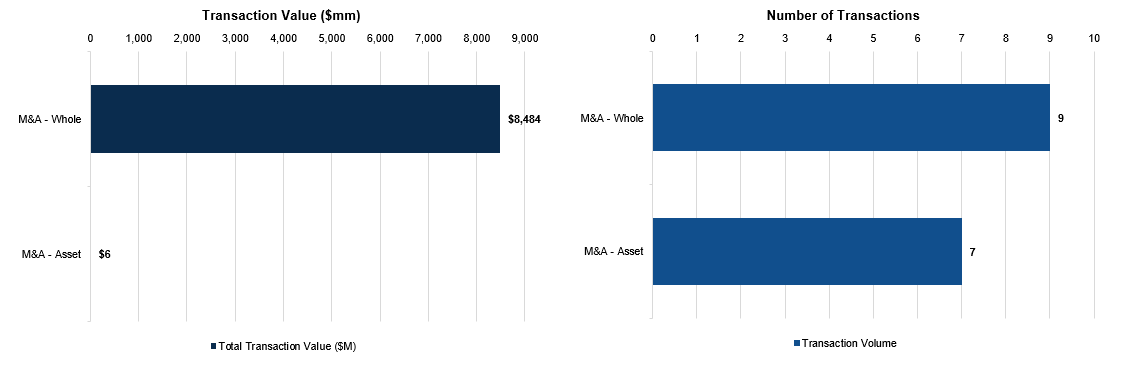

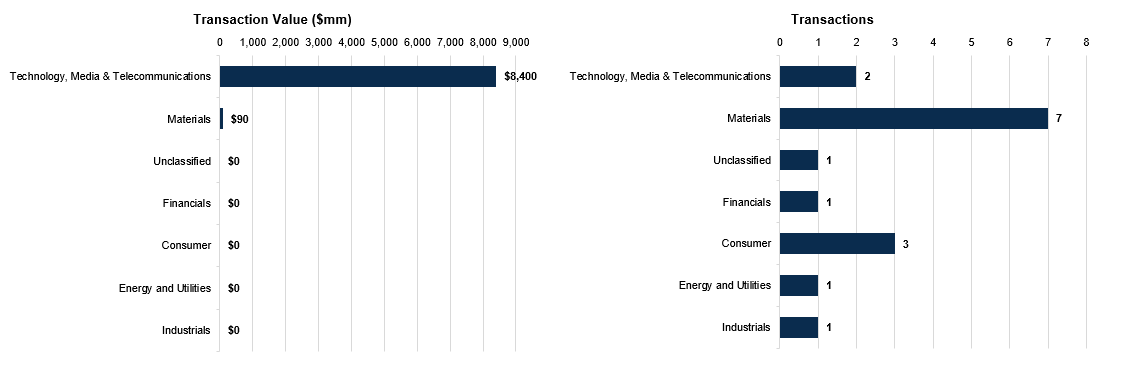

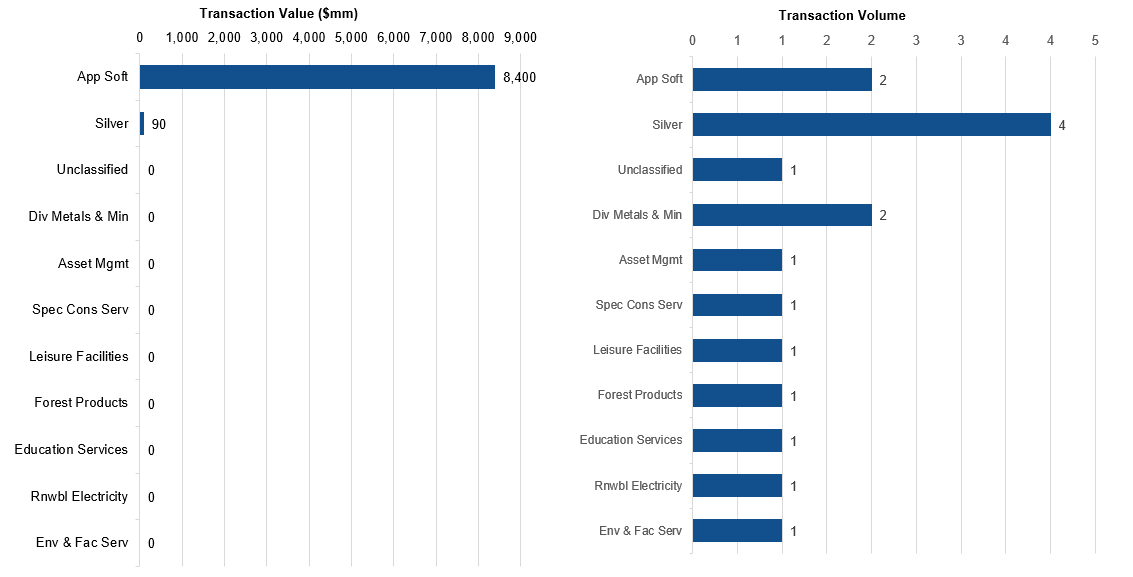

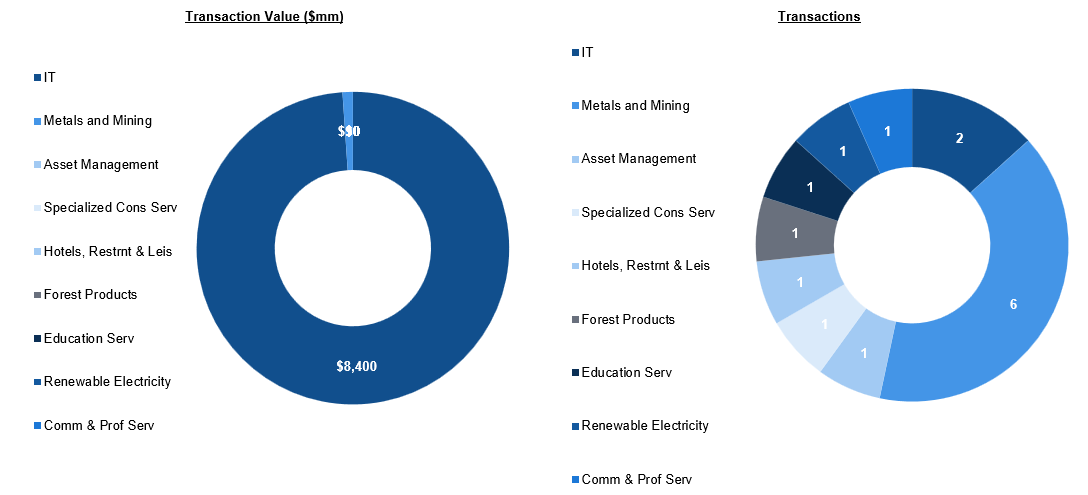

This Quarter - National Transaction Value ($bn) and Transaction Count

Targets in Idaho

Idaho M&A Overview — Business Sale Activity for M&A Targets

Idaho’s M&A market in Q4 2025 reflected a dynamic blend of natural resources, technology, energy, and consumer-facing platforms, underscoring the state’s increasingly diversified economic base. Mining and mineral exploration were particularly active, with transactions such as the $84 million acquisition of Crescent Silver, LLC by Americas Gold and Silver Corporation and multiple claim and project consolidations across the Silver Valley and broader exploration districts. Buyers including Red Mountain Mining Limited and Pioneer Lithium Limited expanded their mineral rights portfolios, signaling sustained long-term conviction in domestic critical materials and precious metals development. Renewable energy investment also remained visible, with rPlus Energies adding two solar and storage projects to strengthen clean power generation capacity across the region.

Technology and data-driven businesses once again demonstrated Idaho’s growing strategic relevance. The $8.4 billion acquisition of Clearwater Analytics Holdings, Inc. represents one of the most significant transactions in the state’s history, reinforcing Boise’s reputation as a hub for institutional-grade financial technology. In parallel, Tackle.io, Inc.’s acquisition by AppDirect, Inc. highlights continued buyer appetite for cloud infrastructure, partner ecosystem management, and recurring SaaS revenue models. These transactions illustrate how Idaho-based platforms are attracting both strategic consolidators and institutional capital seeking scalable, high-margin technology assets.

Beyond headline deals, Q4 activity spanned healthcare services, construction materials, multifamily housing, wealth management, and family entertainment. The acquisition of Silverwood, Inc. by Herschend Family Entertainment Corporation demonstrates continued interest in experiential and destination-driven assets, while regional consolidations in building supply, advisory services, and rental housing reflect steady in-migration and infrastructure demand. For Idaho business owners, the quarter reinforces a clear theme: well-positioned companies—particularly those with durable cash flows, asset backing, or technology-enabled models—continue to command strong strategic interest from both national buyers and private equity sponsors.

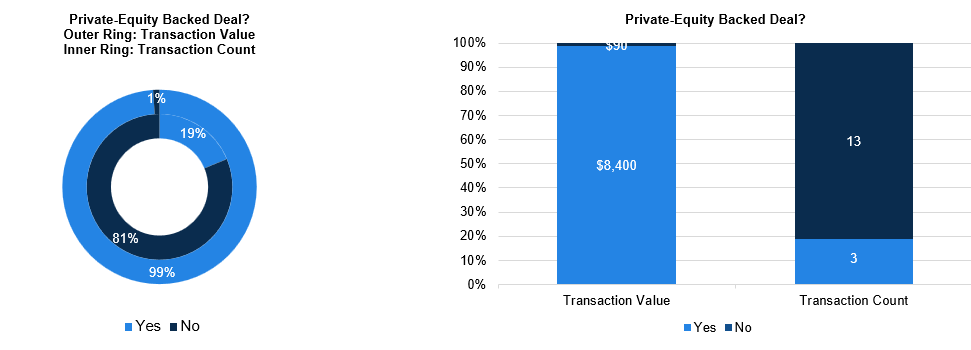

Idaho — Strategic vs. Sponsor-led Activity

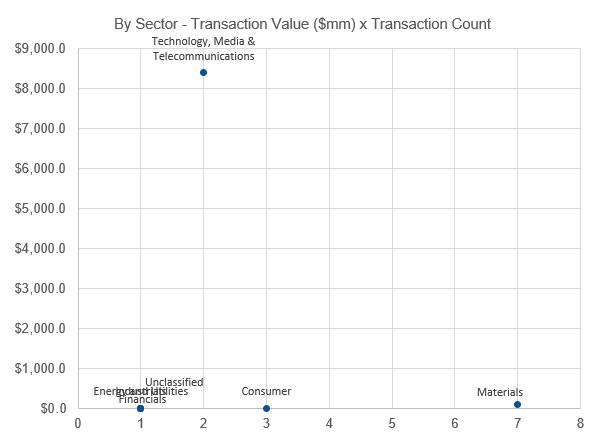

Idaho — X / Y Plot By Sector

Idaho — M&A Segmentation

Idaho — Sector Breakdown

Idaho M&A Deal Summaries — Business Sale Activity for M&A Targets

The following transactions represent M&A activity where the target entity is headquartered in described geography, in line with the traditional reporting on target M&A deal volume and metrics captured in the charts and conventional analysis above.

1. Silver Dollar Project (10/7/2025)

Red Mountain Mining Limited acquired Silver Dollar Project, expanding its precious metals portfolio and strengthening its mining asset base.

2. Triad Behavioral Health LLC (10/13/2025)

Level Education Group LLC of South Jordan, UT, acquired Triad Behavioral Health LLC of Coeur d'Alene, ID, strengthening its behavioral health services portfolio and expanding its geographic footprint in the Pacific Northwest.

3. Waste Technology Services, LLC (10/14/2025)

Northstar Recycling Company, Inc. of East Longmeadow, MA, acquired Waste Technology Services, LLC of Lewiston, ID, expanding its waste management operations into the Pacific Northwest market.

4. Fahey Property (10/20/2025)

Silver Hammer Mining Corp. acquired Fahey Property for $2M, expanding its mineral exploration footprint and resource development capabilities.

5. Ranger-Page Property (10/27/2025)

Silver Valley Metals Corp. of Kellogg, ID, acquired Ranger-Page Property for $4M, expanding its mineral exploration portfolio in the prolific Silver Valley mining district.

6. 41 Lode Claims (11/3/2025)

Pioneer Lithium Limited acquired 41 Lode Claims, expanding its mineral rights portfolio and strengthening its position in lithium exploration and development.

7. Silverwood, Inc. (11/12/2025)

Herschend Family Entertainment Corporation of Peachtree Corners, GA, acquired Silverwood, Inc. of Athol, ID, strengthening its portfolio of family-focused theme park and entertainment destinations.

8. Crescent Silver, LLC (11/13/2025)

Americas Gold and Silver Corporation acquired Crescent Silver, LLC of Kellogg, ID for $84M, consolidating its precious metals mining operations in the strategic Idaho silver district.

9. Two Solar and Storage Projects (11/13/2025)

rPlus Energies, LLC of Salt Lake City, UT, acquired Two Solar and Storage Projects, strengthening its renewable energy portfolio with additional clean power generation and battery storage capabilities.

10. Additional Claims (11/20/2025)

Red Mountain Mining Limited acquired Additional Claims, expanding its mineral resource base and exploration opportunities.

11. Tackle.io, Inc. (12/1/2025)

AppDirect, Inc. of San Francisco, CA, acquired Tackle.io, Inc. of Boise, ID, strengthening its cloud marketplace platform with enhanced partner ecosystem management capabilities.

12. Snake River Truss & Components, LLC (12/5/2025)

Franklin Building Supply Co. of Boise, ID, acquired Snake River Truss & Components, LLC of Idaho Falls, ID, strengthening its structural building components capabilities across Idaho's construction markets.

13. 175-unit River Edge (12/8/2025)

Investor Group acquired 175-unit River Edge, expanding its multifamily residential portfolio in the rental housing market.

14. Mcconnell Financial Advisors, LLC (12/16/2025)

Mercer Global Advisors Inc. of Denver, CO, acquired Mcconnell Financial Advisors, LLC of Boise, ID, strengthening its wealth management presence in the Pacific Northwest market.

15. Riverside, Inc. (12/17/2025)

Impel Company of Bellevue, WA, acquired Riverside, Inc. of Parma, ID, strengthening its regional presence in the Pacific Northwest market.

16. Clearwater Analytics Holdings, Inc. (12/21/2025)

Investor Group acquired Clearwater Analytics Holdings, Inc. of Boise, ID for $8,400M, consolidating its position in the investment management technology and analytics software market.

M&A Segmentation — Glossary:

M&A – Whole: The acquisition of 100% ownership of a target company, giving the buyer full control.

M&A – Asset: The purchase of specific assets, such as mineral rights or property, without acquiring the entire company.

M&A – Minority: The acquisition of a non-controlling stake, typically under 50%.

M&A – Spinoff or Splitoff: The divestiture of a business unit into a separate entity or distribution of subsidiary shares to shareholders.

Deal Terms — Glossary:

Transaction Value: Represents the total consideration paid for a transaction, including net debt only if assumed, capturing the full financial scope of the deal.

Deal Value: Focuses solely on the consideration paid for the equity acquired, excluding net debt, to reflect the cost of ownership.

Implied Enterprise Value: Provides a standardized measure of the target’s total entity value, incorporating 100% of the enterprise including net debt, for consistent comparison with metrics like LTM EBITDA and Revenue.

Implied Equity Value: Isolates the equity portion, representing 100% of the target’s equity value, enabling a clear equity-to-equity comparison across transactions.

Copyright ©2026 William & Wall, S&P Global Market Intelligence