Notes For IB Applicants: Blizzards, Midterms, and the AI Paradox

With or without catch-ups with old mentors and colleagues, it happens every so often—something pulls New York back into focus, and suddenly I’m not in a conference room in Scottsdale anymore. I’m twenty-something and tired, spilling out of Grand Central with a banker bag and a cheap coffee, carried forward by rushing commuters and the steady pulse of BlackBerry alerts in my pocket.

With William & Wall’s Spring 2026 internship applications closing today, maybe it’s fitting that my mind drifts back to the start of my own recruiting journey. In the span of six days, I made four coast-to-coast swings, trying to stitch together a future I wasn’t even sure I belonged in yet. I missed a midterm for it. The professor told me flatly to withdraw from the class. In my mind, I was just trying to prove my university belonged in those interview rooms. “No exceptions,” he said. That stuck too.

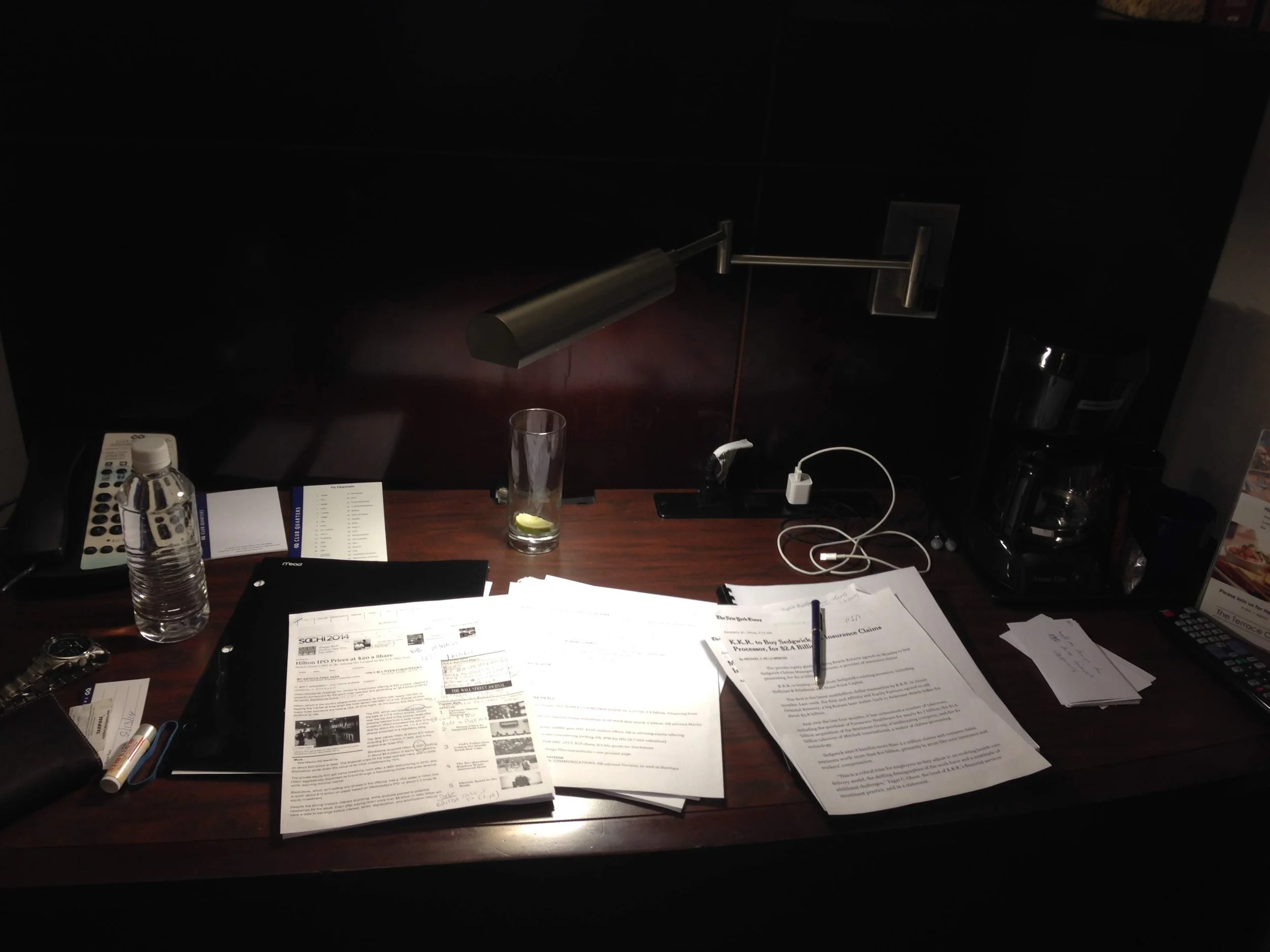

Prep materials on the desk of my Midtown hotel room the night before my first Superday (2014).

I remember arriving at the Club Quarters in Midtown, grabbing a quick bite alone at the corner restaurant, then returning to my room and reviewing technicals until my eyes blurred. The next morning I woke up to a blizzard. Every wind tunnel on those city blocks froze my face. I finally hailed a cab as my hands went numb, and next thing I knew I was sitting on the forty-second floor of a bulge-bracket investment bank, waiting in a line of students who looked like they were queued for doctor’s appointments. My name was called. I walked into a room with two senior bankers, and the backdrop looked like buildings were swaying under the whistling gusts and snowstorm outside. It was a scene out of a movie.

Blizzard conditions in Manhattan, wind-chill in full effect (2014).

If you’re reading this from a campus that isn’t on the usual Wall Street recruiting circuit, I want you to hear something plainly: I wasn’t born into this world either. I forced my way in—one email, one mock interview, one late night at a time.

It was a memorable chapter in my life: youthful adventure, long odds, delusional self-belief, and a lot of faith. Pretty much everything remains the same for recruits today…except one thing. Investment banking is even more popular now, and the era of artificial intelligence has arrived.

AI isn’t just shifting workflows or how models get built; it’s reshaping the funnel of who even gets a shot at walking into a summer analyst bullpen at a bulge bracket or elite boutique.

If you zoom out and imagine the annual applicant pool as a massive scatterplot — tens of thousands of dots representing undergrads, MBAs, non-traditionals, and the occasional wildcard — the distribution has always shown some predictable clustering. Roughly 15–20% fall into the legacy and relationship-based category: sons and daughters of clients, institutional relationships, longstanding family ties, the quietly influential. Another 50–60% land in the core pipeline — the Ivy and semi-target bloc: Penn, Cornell, Yale, Dartmouth, MIT, Harvard, Stanford, Northwestern, Michigan Ross, Berkeley Haas, UVA McIntire…the usual suspects. That leaves perhaps 20–25% of true open-market slots for the rest of the country: the state-school grinders, the self-starters, the people climbing uphill without a built-in tailwind.

Historically, that last cohort still had a path if they were willing to out-prepare and out-compete. But here’s the conundrum: AI is making the applicant pool more crowded, more compressed around the middle, and harder to differentiate. The natural advantage once held by top-performers—technical polish, modeling fluency, formatting sharpness—is diminishing. If everyone can produce a clean first draft, how do you distinguish the candidates who actually understand the logic from the ones who simply prompted an LLM?

Then layer on the in-person realities for summer analysts and full-timers. Will future generations build models from scratch? Will they live through the muscle memory of making mistakes and fixing them at 3:42 a.m.? Will they assume that v1.0 of a pitch deck equals vFFF just because a machine produced it?

Layer on the workplace realities of the post-COVID era—remote onboarding, fragmented training, and uneven development cycles—and it’s understandable why some banks have struggled with consistency across intern classes. Many senior people are quietly wondering what the next decade of junior talent will look like.

Simulated distribution of perceived investment banking application quality before and after AI.

And yet, paradoxically, the playing field has never been more open. If the scatterplot is flattening, authenticity becomes one of the last differentiators that cannot be automated. Real curiosity. Real repetition. Real connection. Real grit. Across the last several application cycles at William & Wall, the candidates who rose to the top weren’t the ones with perfect résumés or AI-polished emails—they were the ones who followed nuanced application instructions, communicated like human beings, and demonstrated the processing power to handle live technicals and cheat-proof case studies. That mattered then, and it will matter even more now.

Do your part. Build the fundamentals. Build your network. Make trips. Meet people. Speak up. Lean into the depth that AI cannot replicate. Then let the score take care of itself. The pendulum will swing back in the human direction for the right investment-banking firms. And if they’re late to that shift, they’re not the right place for you.

The application deadline for William & Wall’s Spring 2026 M&A Analyst Internship is November 17, 2025. This program offers immersive training, mentorship, and skill-building designed to prepare students for the world of investment banking. For more information visit www.williamandwall.com/careers.